Congestion continues to be one of the major issues causing delays at U.S. terminals due to increased volume. Labor shortages and equipment shortages are also contributing to supply chain delays.

What is Congestion?

Congestion occurs when a terminal becomes overwhelmed by shipments

and must handle more containers than the terminal is typically prepared to manage. Processes will inevitably slow down while terminal operators attempt to manage the increased flow of shipments.

U.S. EAST COAST

Vessel operators are reviewing schedule recovery measures as carry-on delays from Asia and Europe perpetuate further delays into U.S. East Cost terminals. Blank sailings have been announced in Europe to bring vessels back on schedule.

Chassis shortages are ongoing due to increased volume at inland rail facilities and terminals across the coast.

New York | New Jersey HIGH CONGESTION

Terminals are expecting 24 to 48-hour vessel berthing delays for the next two weeks as imports rise. Chassis shortages are ongoing and truck turn times at the terminals are between 3 to 7 hours to pull a single container.

Limited equipment and congestion continue to effect rail delays for containers moving to and from MMR rail facility and NYC terminals such as Port Newark Container Terminal and APM Terminals. It is taking 3 to 8 days to load rail, and an additional day or two to depart.

The number of days of lead time required to secure truck capacity has increased since last week. The standard lead time in the U.S. is 2 days, however, in New York, the truck order lead time is currently 6 days.

Atlanta MEDIUM CONGESTION

Vessel delays at the ports in Savannah and Charleston are 3-4 days, due to the high amount of cargo moving in.

Chassis street dwell is on average 3 days, and in some cases up to 10 days. Truck turn times at the ports, however, are fairly normal.

Miami MEDIUM CONGESTION

Vessels are arriving 4 to 5 days after their ETA causing vessel bunching. Terminal operators are overwhelmed by the congestion and are double staking containers. Truck turn times at the terminals are up to an average of 4 hours.

U.S. GULF COAST

Houston LOW CONGESTION

Vessel berthing delays from 0 up to 12 hours. Truck turn times at the terminals is 2-3 hours. Truck order lead time is up to 4 days.

U.S. WEST COAST

Carry on delays from Asia are causing further delays for some vessels heading to U.S. West Coast terminals. Other vessel delays are due to congestion and labor shortages in Long Beach and port congestion in Australia and Vancouver.

Due to increased volume at West Coast terminals, equipment shortages continue to be a major concern.

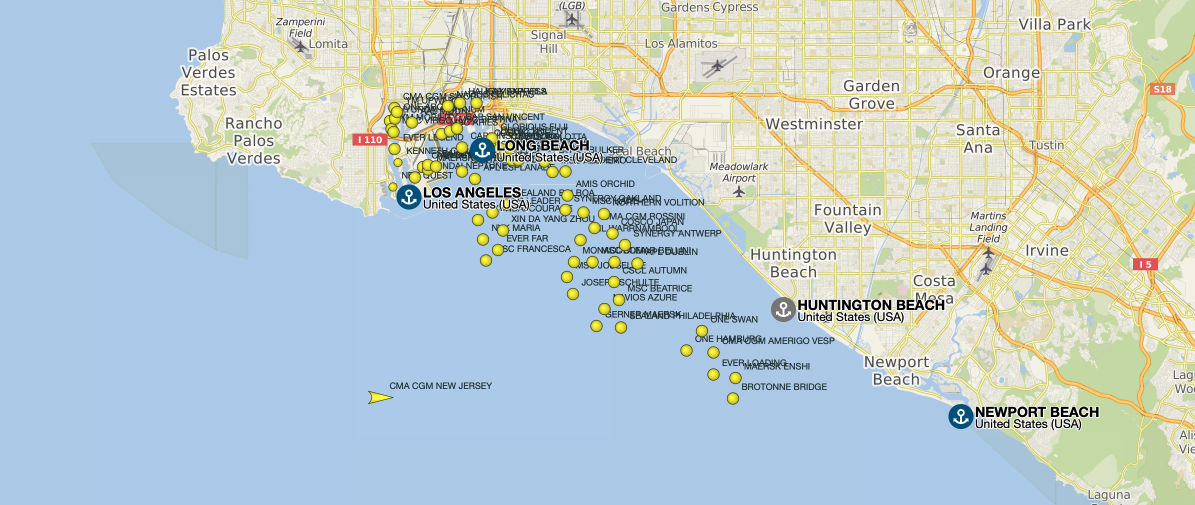

Los Angeles | Long Beach VERY HIGH CONGESTION

Due to labor shortages and high import volumes, vessel wait times have shot up to 10-14 days. Ships have filled all usable anchorages off Los Angeles and Long Beach and six of the 10 contingency anchorages off Huntington.

The port of Los Angeles predicts imports to increase from 143,776 TEUs this week to 157,763 TEUs next week, and to 182,953 TEUs the week of Jan. 24-30.

Equipment availability is extremely limited. Average terminal dwell for 20ft container chassis is 10 days and 5 days for 40/45ft chassis. Street dwell times are now up to averages of nearly 10 days for 20ft chassis and nearly 8 days for 40/45ft chassis.

There are delays in picking-up and delivering containers at Los Angeles rail terminals, also due to congestion and labor shortages.

Truck order lead time in Los Angeles and Long Beach is currently up to 10 days.

Seattle | Oakland | Tacoma LOW CONGESTION

Due to congestion, vessel wait times are between 12-36 hours in Seattle. In Oakland, there are labor shortages driving up vessel wait times to 3 days. Each of these areas are seeing 3-day truck order lead times. A 2-day lead times is typically the standard.

Stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.