IMO 2020

Starting January 1, 2020, the International Maritime Organization’s (IMO) Low Sulfur Fuel Mandate will go into effect impacting all-sized ships operating domestically and internationally.

Because the sulphur oxides that are produced as a result of heavy fuel oil distillation are harmful to human health, in the form of respiratory lung diseases, as well as the atmosphere, causing acid rain harmful to both agriculture and aquatic life; the goal of the new IMO 2020 regulation is to lower the cut sulfur content in maritime fuel from 3.5% to that of 0.5% in order to reduce air pollution.

WHY IS THIS BETTER FOR HUMAN SAFETY?

“Delays in implementation of global sulphur limits from 2020 to 2025 would contribute to more than 570,000 additional premature deaths compared to the implementation from 2020. Health benefits are related to the proximity of coastal communities and major shipping lanes.”

2016 IMO: Air Pollution And Energy Efficiency Report by Finland

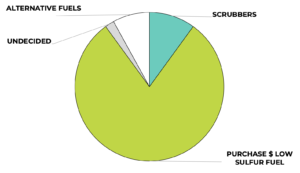

Vessel operators have four options to address the IMO’s low-sulfur requirement:

- installing exhaust gas cleaning systems, known as “scrubbers”;

- blending fuels to lower sulfuric content;

- modifying ship engines to use alternative fuels, such as liquified natural gas (LNG); and

- purchasing expensive low-sulfur fuel (roughly 30% higher in price than heavy fuel oil).

It is estimated that roughly 80% of ocean carriers will choose to purchase low sulfur fuel versus the 10% choosing to retro-fit vessels with scrubbers or use alternative LNG fuels.

It is estimated that roughly 80% of ocean carriers will choose to purchase low sulfur fuel versus the 10% choosing to retro-fit vessels with scrubbers or use alternative LNG fuels.

Scrubbers are the least popular option because of cost and time out-of-service. Re-fitting a vessel can cost anywhere from $2 – $3 million, whereas retrofitting an existing vessel can cost around $4 million, which doesn’t include the cost of lost business from pulling the vessel from rotation.

Low Sulfur Increase to fuel cost – $200 to $350 per ton

Scrubber est. investment – $7M to $8M per ship

LNG est. investment – $15M to $25M per ship

BUNKER ADJUSTMENTS & SURCHARGES

Great change, typically, comes at a cost. And because of the Federal Maritime Commission’s (FMC) 30-day rate filing requirements, shippers can expect to see additional surcharges and bunker adjustments as soon as October 1, 2019.

Because the price spread between high- and low- sulfur fuel is important in determining the level of Bunker Adjustment Factor (BAF) shippers can expect, carriers have begun announcing combinations of floating fuel surcharges and BAF matrixes to help estimate the potential cost structures.

Shippers can expect BAF and surcharges to vary by carrier, as the low level of LSF traded on the market makes demand and overall cost difficult to project. While the industry hopes to keep pricing changes simple, most carriers have turned to trade consulting firms to assist and have proposed two levels of pricing; one for long-term contracts and another for short term rates.

long term contract

FREIGHT + FLOATING BAF (QUARTERLY) + LOCAL LSF

FLOATING BAF = (FUEL COST X TRADE IMBALANCE) / LIFTING FACTOR

short term contract

FREIGHT + ADD-ON SURCHARGE/EFF* + LOCAL LSF

*Environmental Fuel Fee (EFF)

ADD-ON SURCHARGE/EFF = 3 MONTH LSF BAF – 3 MONTH HSF BAF

In July, very low-sulfur fuel oil (VLSFO) was at a best $100 to $150 more expensive per ton than heavy-sulfur fuel oil (HSFO), but currently that number sits at around $188 USD. Since carriers don’t have any way to calculate what fuel pricing will be in November-December, the peak season for holiday shipping, shippers can expect a mix of bunkers adjustments and surcharges until the market normalizes.

2019 EST. BAF RANGE (3.5% SULFUR FUEL) – $350 – $500

2019 EST. ADD-ON/EFF SURCHARGE – $150 – 210

2020 EST. BAF (0.5% SULFUR FUEL) – $550 – $700

The additional cost of converting global shipping fleets to low-sulfur fuels will be passed from carriers to shippers, and ultimately, to consumers.

As Green continues to monitor the situation, stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.