In September, rail container dwell times at the ports of Los Angeles and Long Beach hit a two-year high. This spike coincided with record import volumes from Asia, largely because retailers began diverting cargo from U.S. East and Gulf Coast ports in preparation for the ILA longshore strike. While truck dwell times for containers leaving the LA-LB complex also reached new highs, terminal operators maintain that the average of 3.21 days has not contributed to congestion in the ports.

PORTS RECORD RECORD IMPORT VOLUMES IN SEPTEMBER

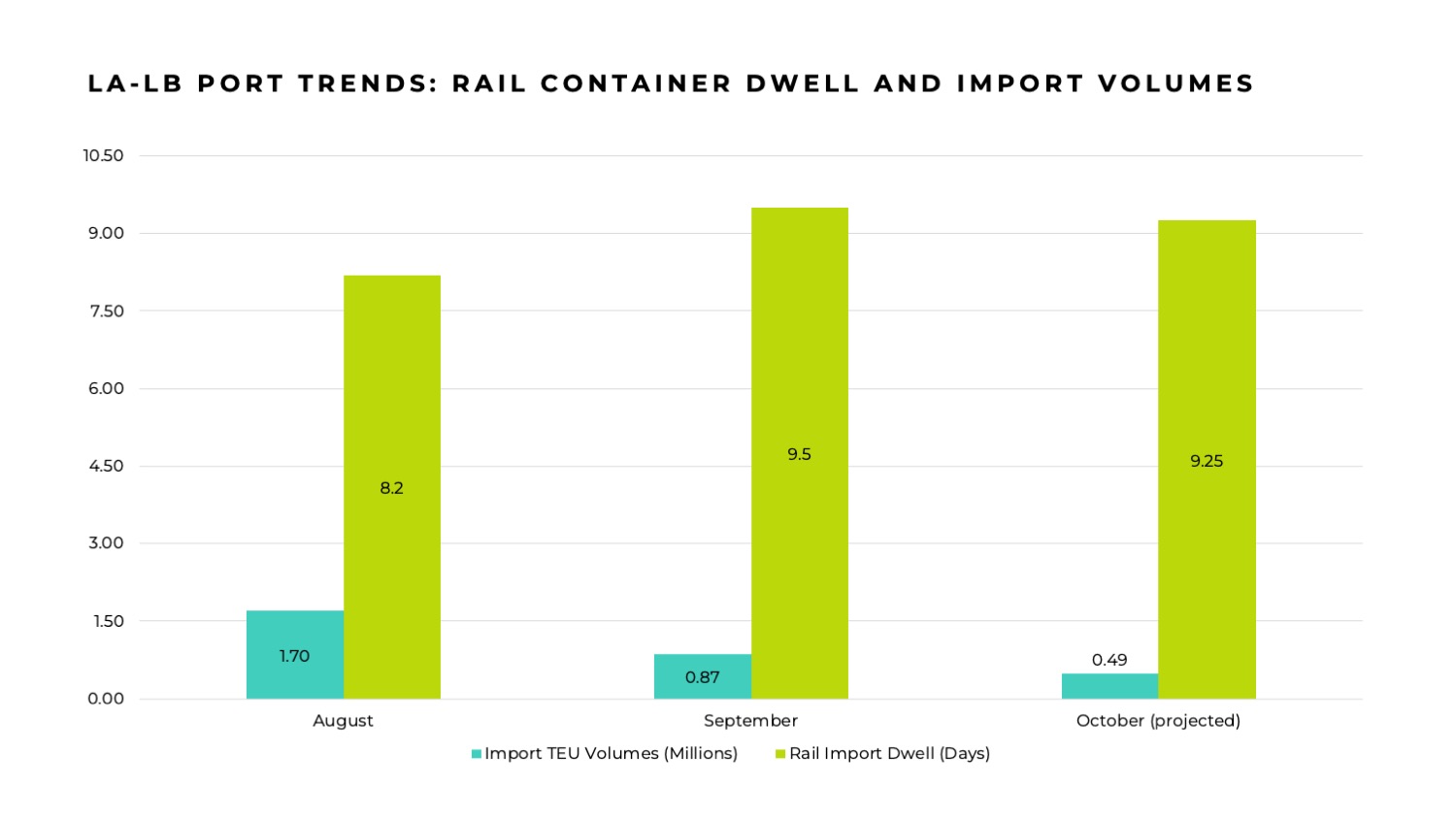

The Los Angeles-Long Beach port complex processed 874,730 TEUs of imports from Asia in September, surpassing the previous one-month record of 873,196 TEUs set in May 2022 during the post-COVID import boom. This surge in imports drove rail container dwell times up to an average of 9.5 days, rising from 8.2 days in August and marking the highest level since October 2022, when dwell times peaked at 14.2 days.

EXPECTATIONS FOR NOVEMBER IMPORT VOLUMES

Looking ahead, terminal operators expect a slowdown in imports during the typically quieter month of November. Imports from Asia reached 1.76 million TEUs in July, the highest figure since May 2022, but this number has gradually declined, with September seeing 1.72 million TEUs—still high but trending downward.

INCREASED CARRIER ACTIVITY AMID HIGH IMPORT LEVELS

To handle the high volumes, carriers added 28 extra-loader vessels in September and October, supplementing their regular weekly services on the eastbound trans-Pacific route to Los Angeles-Long Beach. However, only two extra-loaders are scheduled to call at the terminals in November, which suggests that both import volumes and rail dwell times may be set to decline.

PROJECTED IMPORT TRENDS

Imports in Los Angeles are expected to peak at 120,664 TEUs during the week of October 20. Long Beach is projected to see imports decrease from 102,756 TEUs next week to 87,780 TEUs during the week of October 27. November typically brings a lull in eastbound trans-Pacific trade as most holiday merchandise arrives by late October, allowing retailers to prepare for Black Friday sales.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.