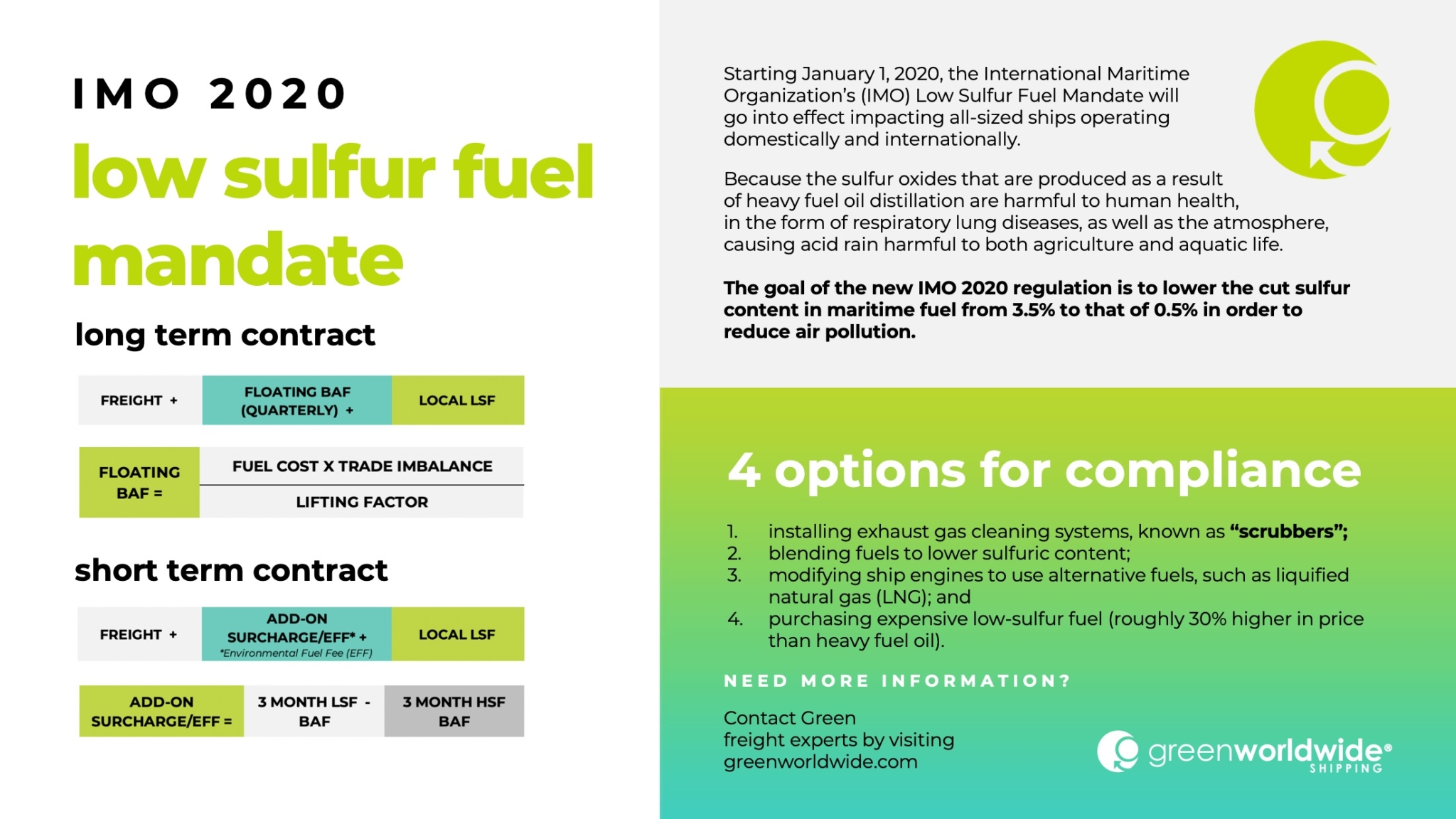

Shippers and the transportation industry are bracing themselves as the International Maritime Organization’s (IMO) Low Sulfur Fuel Mandate goes into effect January 1, 2020.

FUEL PRODUCTION

Global oil refineries have also been scrambling to try and meet the demand for a transportation industry in flux and with vague demand.

Ocean freight shipping burns about 4 million (bpd) barrels per day of bunker fuels. The new rule changes under the Low Sulfur Fuel Mandate are estimated to impact more than 50,000 merchant ships globally, but also open a competitive new market for fuel producers.

One of the world’s largest refinery began its low-sulfur fuel oil (LSFO) output at 10 refineries in Asia. The Company intends to produce LSFO at a capacity of 10 million tonnes annually by 2020. It is also in the process of building 100 fuel barges over the next 3 years to provision ships with cleaner fuel.

“SCRUBBER” SOLUTIONS

Alternatively, some U.S. refiners have begun importing high-sulfur fuel oil to “scrub” into cleaner fuel for international purchase, as fuel oil hit a three-year seasonal low in the month of October.

According to some industry sources, scrubbers can to remove up to 99% of sulfur dioxides, close to 94% of particulate matter, and up to 60% of carbon and large amounts of polyaromatic hydrocarbons, or PAH.

Some countries, however, have begun to issue notices that prohibit the use of open loop scrubbers on vessels arriving at port. The Malaysian government cited health and environmental concerns over wash water discharged from the open loop scrubbers near ports cities.

“Ships calling to the Malaysian ports are advised to change over to compliance fuel oil or change over to close loop system (if hybrid system) before entering Malaysian waters and ports,” the Malaysian government advised in a statement.

BILLING ALERT

IMO 2020 will also create new administrative headaches for shippers; industry sources suggest that the processing invoices containing low sulfur fuel could cost the industry close to $100 million in discrepancies. Shippers should pay extra attention to prevent inaccuracies in their ocean freight bills.

The surcharges affiliated with the Low Sulfur Fuel Mandate would be assessed like any other surcharge, such as peak season charges, terminal handling charges, or bunker adjustment factor (BAF).

Due to the lack of uniformity across the industry, some container lines are creating their own formulas to calculate low-sulfur fuel charges. In some instances, shippers are using formulas created by third parties to grasp the effects of low-sulfur mandate.

In July, very low sulfur fuel oil (VLSFO) was at a best $100 to $150 more expensive per ton than heavy sulfur fuel oil (HSFO), but currently that number sits at around $188 USD. Since carriers don’t have any way to calculate what fuel pricing will be implemented after December, the peak season for holiday shipping, importers and exporters can expect a mix of bunkers adjustments and surcharges until the market normalizes.

2019 EST. BAF RANGE (3.5% SULFUR FUEL) – $350 – $500

2019 EST. ADD-ON/EFF SURCHARGE – $150 – 210

2020 EST. BAF (0.5% SULFUR FUEL) – $550 – $700

The additional cost of converting global shipping fleets to low sulfur fuels will be passed from carriers to shippers, and ultimately, to consumers.

FUEL PREPARATIONS

Third party consultants are advocating for shippers to perform “dry runs” in order to allow time to fix discrepancies in their bunkers adjustments early on so they can pin-point and resolve any miscalculations before the Low Sulfur Fuel Mandate goes into full swing this January.

Ships who decide to opt for switching their fuel must have vessel piping clear of sludge and sediment build up to prevent low sulfur fuel from being contaminated. Contaminated low sulfur fuel may prevent operators from working in compliance of the Low Sulfur Fuel Mandate.

Most operators are choosing to use fuel that is compliant with regulations rather than installing exhaust cleaning scrubbers to cut down the amount of time their vessels are inoperative.

As Green continues to monitor the situation, stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.