As the U.S. freight market enters Week 51 of 2024, new Panama Canal tariffs and the potential International Longshoremen’s Association (ILA) strike loom large. These challenges, combined with tightening capacity, are beginning to impact shipping operations, particularly along the U.S. East Coast and West Coast.

PANAMA CANAL TRANSIT SURCHARGE

Effective January 1, 2025, the Panama Canal Authority (ACP) will implement changes to its Transit Reservation System and introduce new tariffs. Major carriers CMA CGM and MSC will apply a surcharge for all services transiting the canal. These changes will impact key U.S. East Coast and Gulf routes from Asia, including Southeast Asia, China, Korea, and Japan. This move comes as the ACP addresses increasing global trade demand and capacity challenges.

CMA CGM will apply the surcharge across several services, including the Chesapeake Bay Express (CBX) and Pacific Express 3 (PEX3).

MSC will impose the surcharge for cargo from Southeast Asia, China, Korea, and Japan to U.S. East Coast and Gulf.

These adjustments are part of broader efforts by the ACP to optimize operations amid environmental and logistical challenges.

ILA POTENTIAL JANUARY STRIKE: A MAJOR CONCERN FOR U.S. FREIGHT OPERATIONS

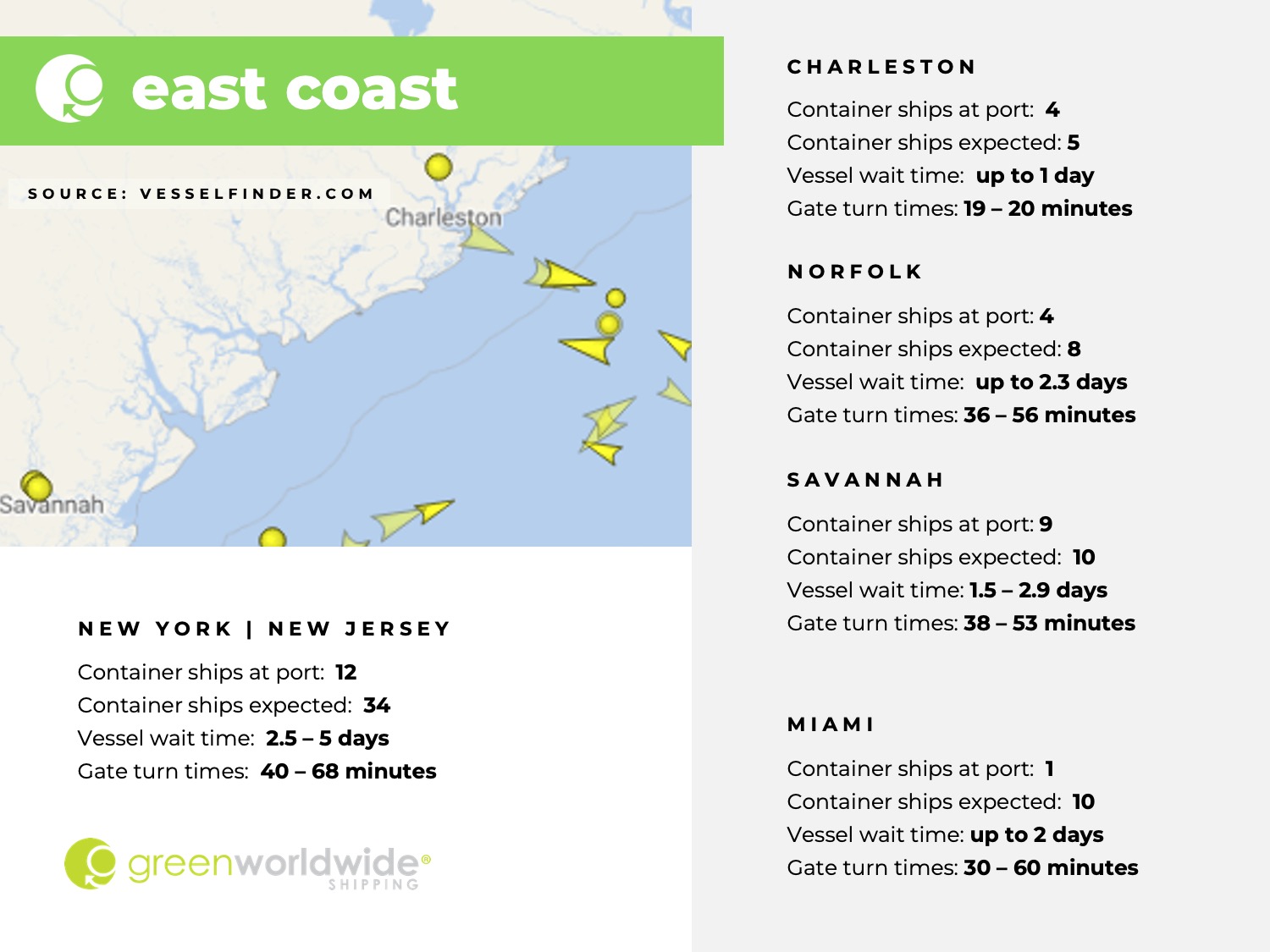

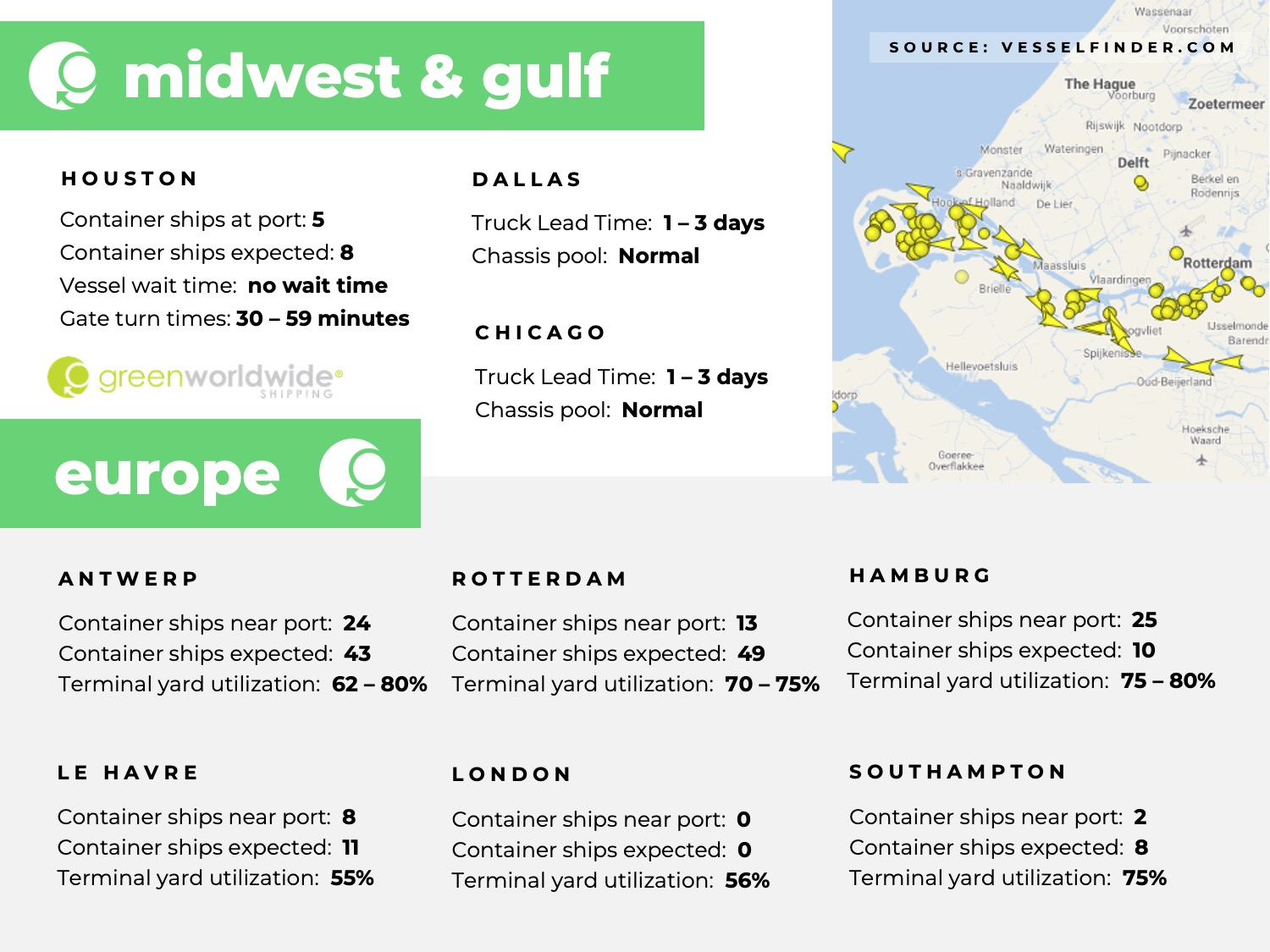

A potential strike by the International Longshoremen’s Association (ILA) in January 2025 casts a shadow over the global supply chain as the new year approaches. Labor negotiations remain stalled between the ILA and the United States Maritime Alliance (USMX). A strike could lead to widespread disruptions at U.S. East Coast and Gulf ports, including major hubs like the Port of New York and New Jersey, Savannah, and Charleston.

Tight container space to U.S. East Coast and Gulf Coast ports, particularly from China, is likely a result of shippers front-loading shipments ahead of the potential strike. Anticipating disruptions, many have accelerated cargo deliveries to avoid delays, leading to capacity constraints on routes to the U.S. East Coast (USEC) and U.S. Gulf Coast (USGC). Container vessel space to U.S. West Coast ports, particularly for the U.S. Pacific Northwest (PNW) is tightening. This suggests that as the January 12, 2025, contract renewal date approaches, shippers may shift more cargo to the West Coast, potentially increasing volumes at ports like Los Angeles and Long Beach, which could lead to congestion, equipment shortages, and blank sailings.

PREVIOUS ILA STRIKE UPDATES

Follow Green Worldwide Shipping’s ongoing coverage of the ILA-USMX contract negotiations updates here:

- ILA Publishes USMX Contract Extension Objectives

- ILA-USMX Reach Tentative Agreement: U.S. Dockworker Strike Ends

- Day Three: Carriers Declare ILA Strike a Force Majeure Event

- Day Two: ILA-USMX Negotiation Stalemate

- Day One: ILA U.S. East Coast Strike Coverage

- Potential Impact Of ILA Strike On U.S. East Coast and Gulf Ports, Carrier Surcharges

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.