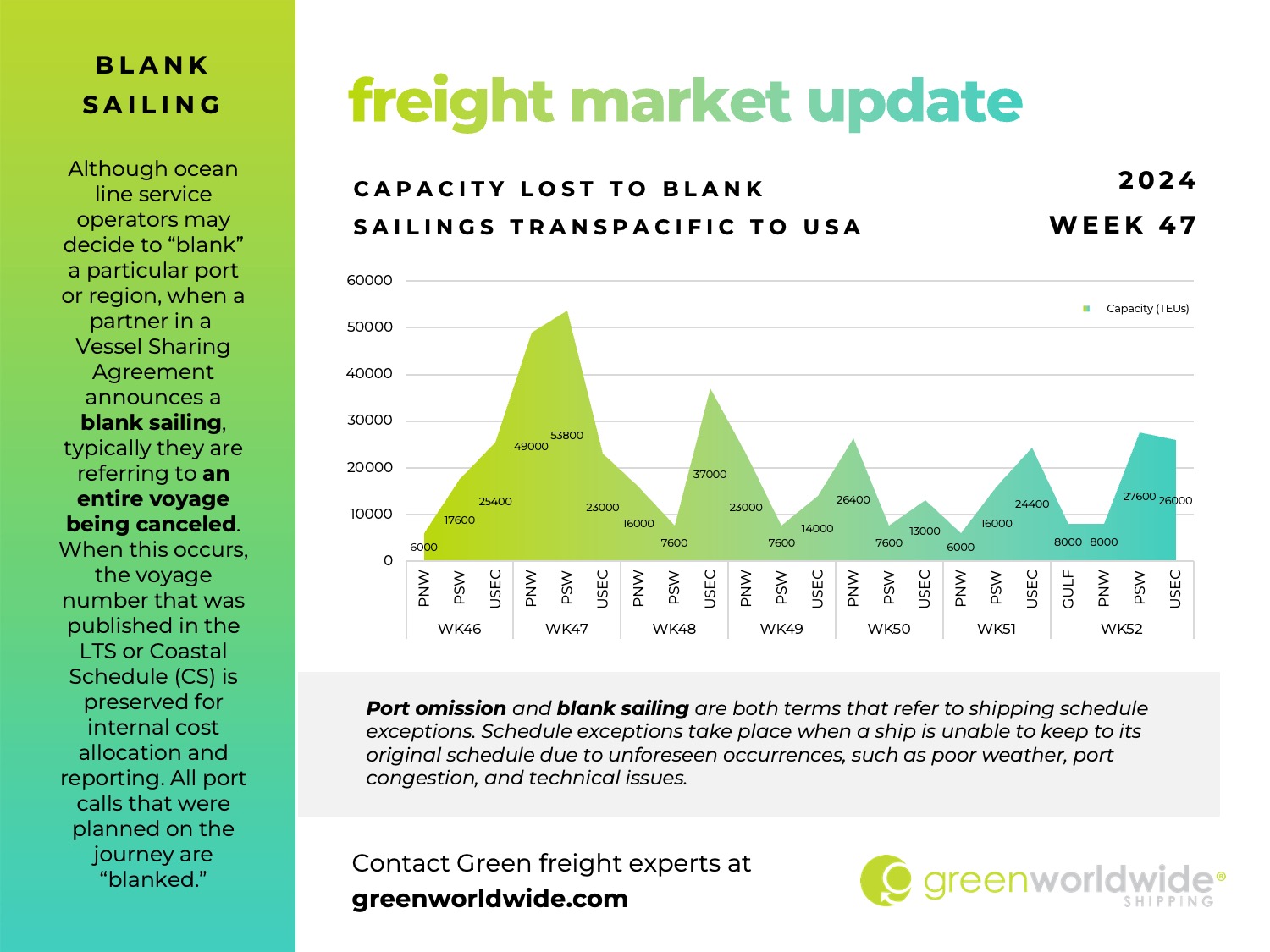

The Week 47 freight market finds labor challenges and congestion continuing to dominate North American shipping. Following the near two-week shutdown at Canadian ports, operations have resumed, but a significant backlog of containers and vessels remains. Clearing this congestion is expected to take several weeks, with some vessels still waiting offshore or delayed at berth for over 13 days. Port authorities are advising slow steaming to ease congestion, while blank sailings on Pacific Northwest (PNW) services are anticipated in the coming weeks. Shippers are urged to plan accordingly as the situation unfolds.

U.S. EAST COAST CONTRACT NEGOTIATIONS STALL

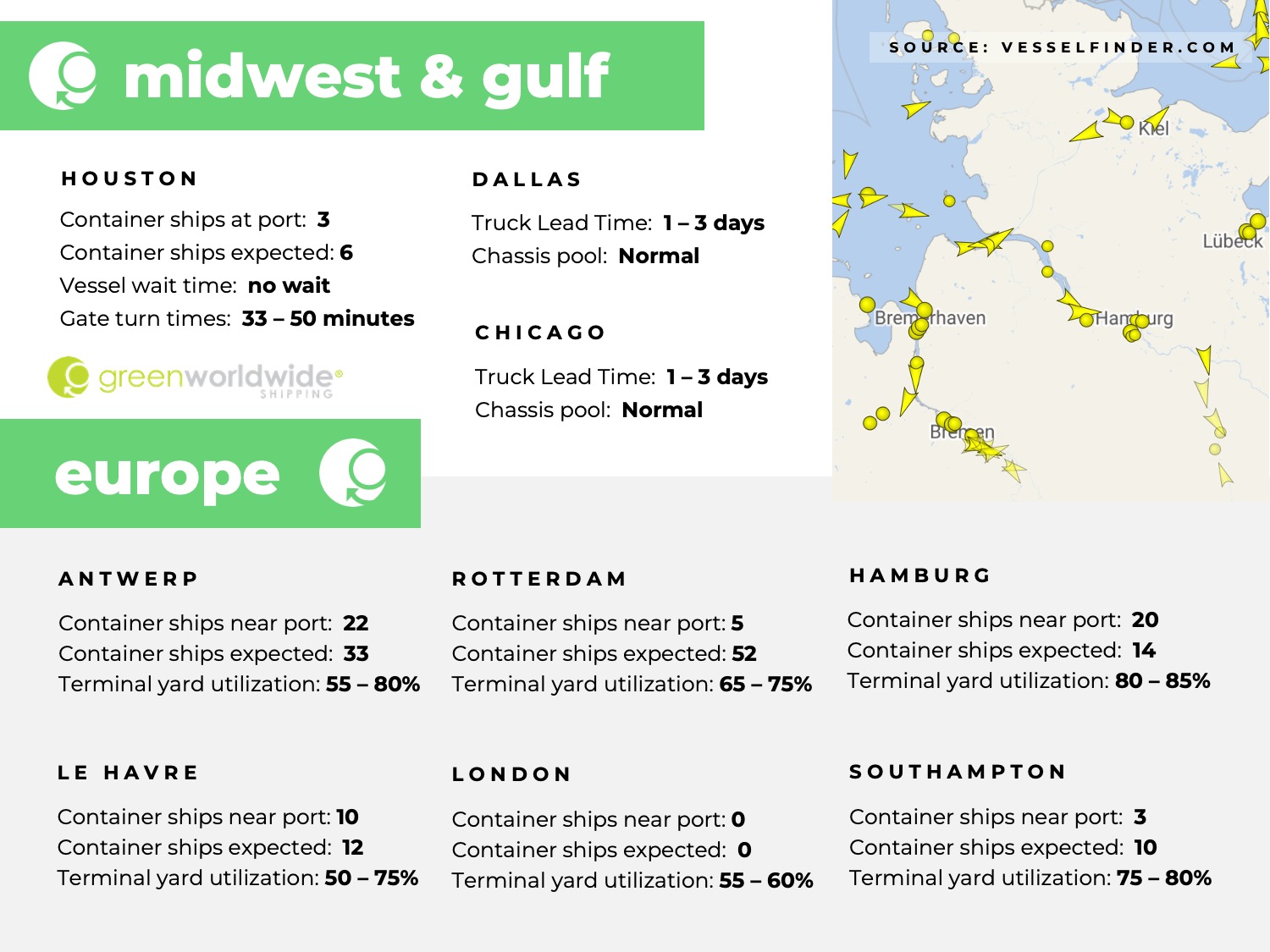

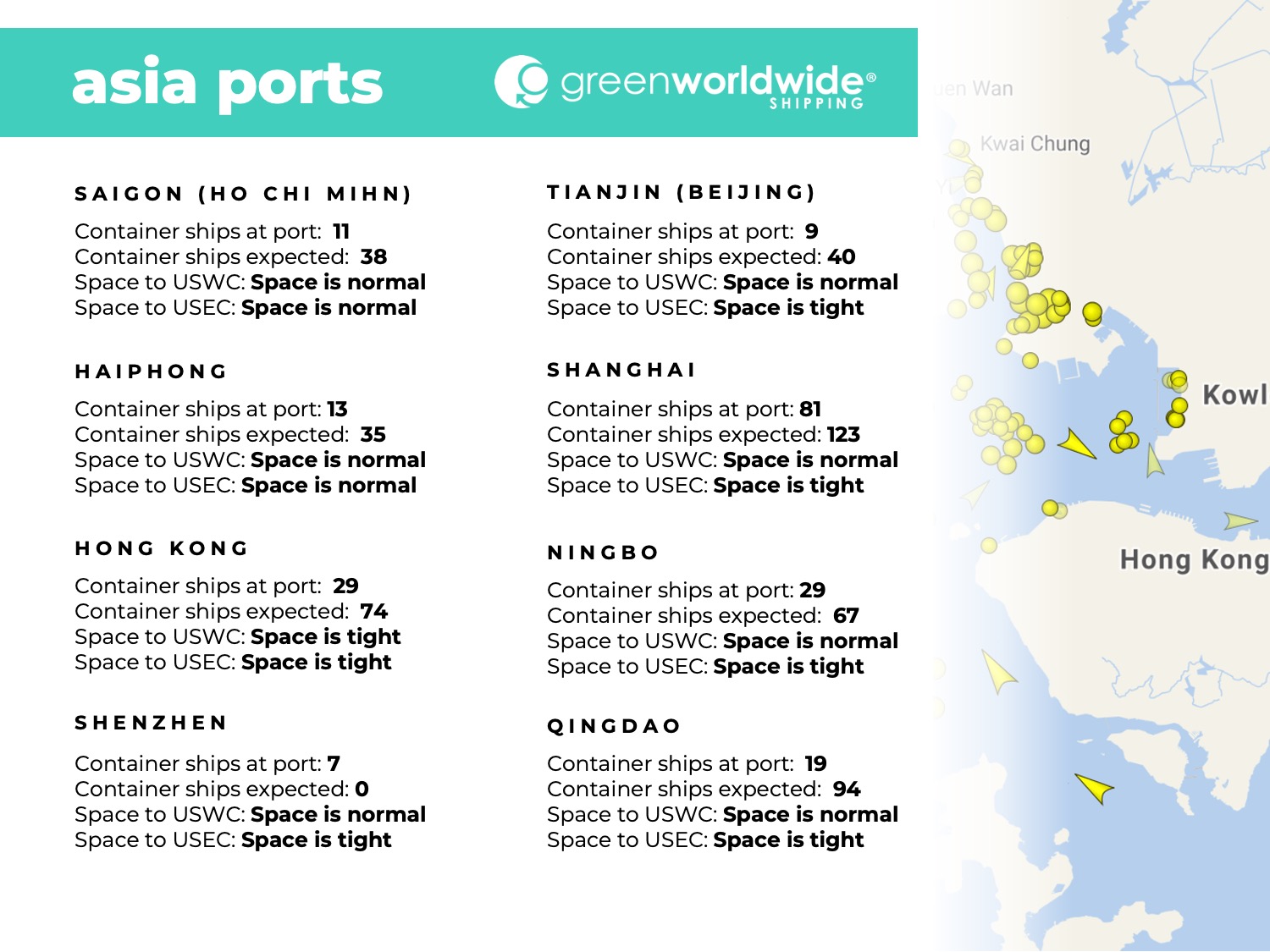

On the U.S. East and Gulf Coasts, labor negotiations are facing continued uncertainty. With a second potential strike looming on January 15, 2025, shippers are facing a critical window to secure capacity. Containers with deadlines for arrival by this date must depart from China by early December to ensure timely delivery, as transit times typically range from 35 to 40 days.

While additional vessels returning to the East Coast provide some short-term relief, demand is expected to dip by mid-December. Shippers are strongly advised to secure bookings as soon as possible to mitigate the risk of disruptions.

NEW U.S. ADMINISTRATION: IMPACT ON GLOBAL TRADE

As the new U.S. administration prepares to take office, the potential for substantial shifts in trade policy is under close scrutiny. Proposed changes to tariffs and free trade agreements could significantly reshape global supply chains, impacting businesses, consumers, and international trade dynamics.

Speculation regarding U.S. trade policy includes the possibility of a 10%-20% across-the-board tariff on imports from countries lacking bilateral trade agreements. Additionally, the expansion of Section 301 tariffs targeting Chinese imports could see tariff rates rise by as much as 100%. There are also indications that de minimis provisions for e-commerce imports from China may be eliminated.

Read a full editorial on the potential impact the U.S. President-Elect may have on global trade here: The New Administration – Free Trade Agreement and Tariff Outlook

As these policies unfold, the shipping and logistics industries must remain agile to navigate potential disruptions and take proactive measures to secure supply chains in an increasingly complex trade environment.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.