CANADA LABOR ACTION OPERATIONAL PORT IMPACT

The lockout and strike at British Columbia’s major ports have continued into a second week, significantly disrupting port operations at Vancouver, Prince Rupert, and Fraser-Surrey. The ILWU Local 514 strike activity began on November 4th, 2024, prompting the BCMEA to initiate a lockout later that same day, which has brought vessel, rail, and truck operations to a standstill. Anchorage utilization in Vancouver reached close to 90% by November 7th, as many carriers initially held vessels at anchor, awaiting updates on the situation.

Efforts to mediate the dispute through federal intervention fell through over the weekend, with no progress reported and no further sessions scheduled at this time. With no immediate resolution expected, several carriers are anticipated to reroute services to alternative U.S. West Coast ports, including Seattle-Tacoma, to manage delays.

MARKET SHIFTS IN TRADE VOLUME AND CAPACITY

In September, transpacific eastbound ocean container volume dropped by 9.1% month-on-month after a strong peak season in July and August. Last week, market activity slowed as industry stakeholders awaited U.S. presidential election results.

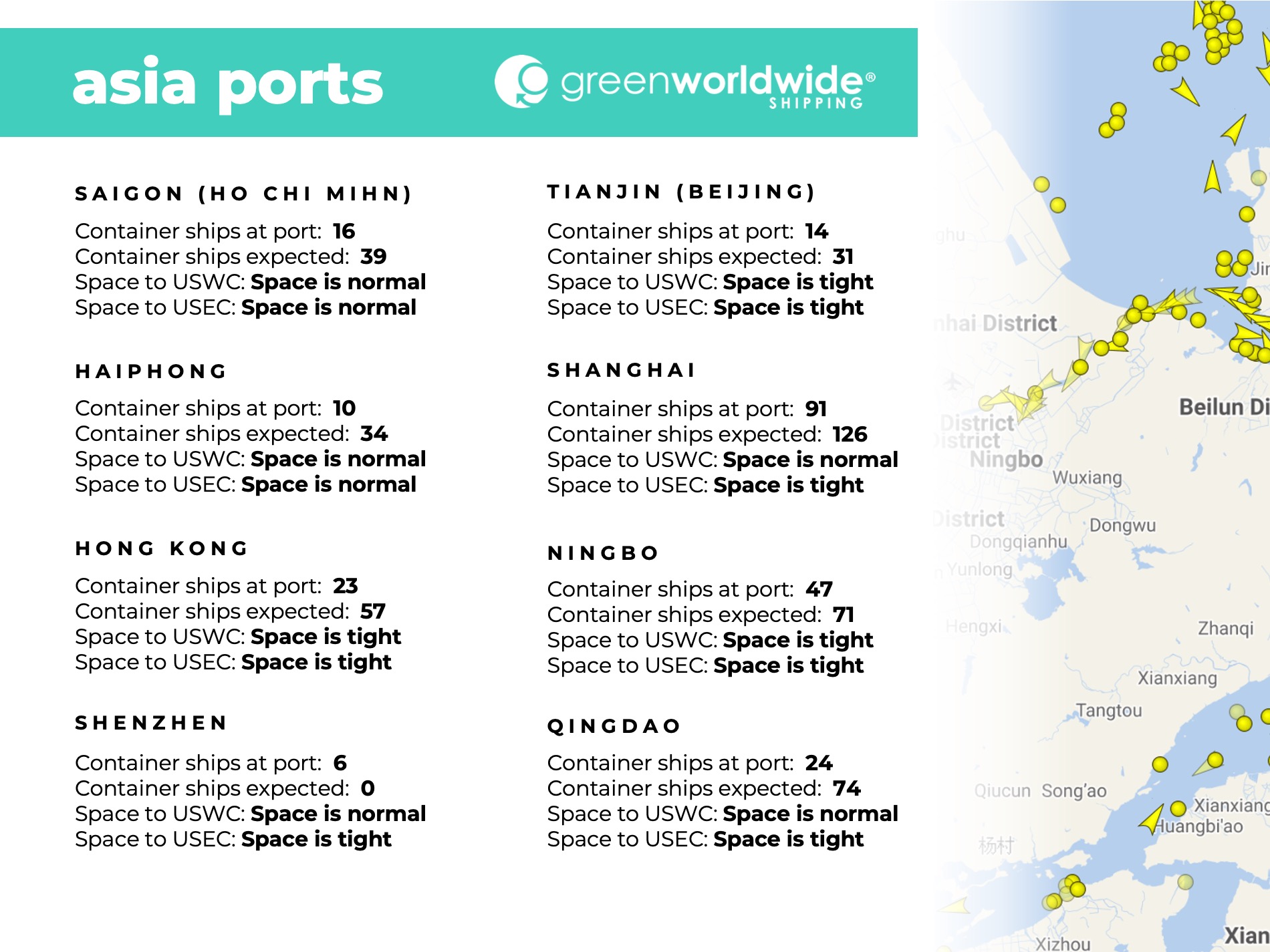

The container shipping industry, particularly in Transpacific trade, has had a generally cautious response to recent developments that may impact U.S. trade policy. The potential of increased tariffs on Chinese-made goods raises concerns about potential slowdowns in trade. In the short term, industry analysts anticipate a surge in imports as businesses seek to stock up before any new tariffs are enforced.

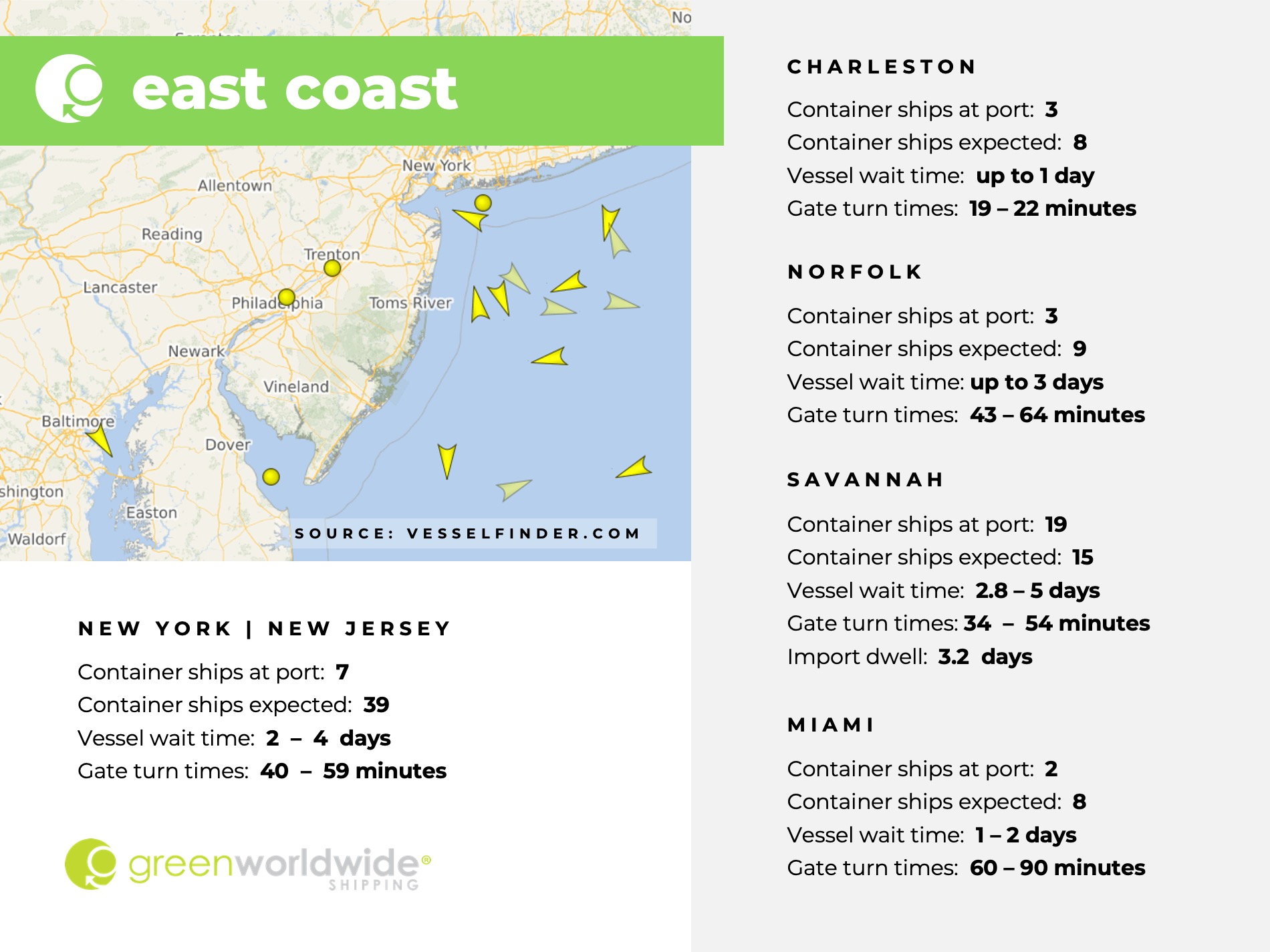

Market conditions vary significantly between the U.S. West Coast (USWC) and U.S. East Coast (USEC). Space availability on the USWC is relatively open, with carriers offering reduced pricing to push cargo. In contrast, the USEC is experiencing tight capacity, with significant blank sailings in November, particularly from China.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.