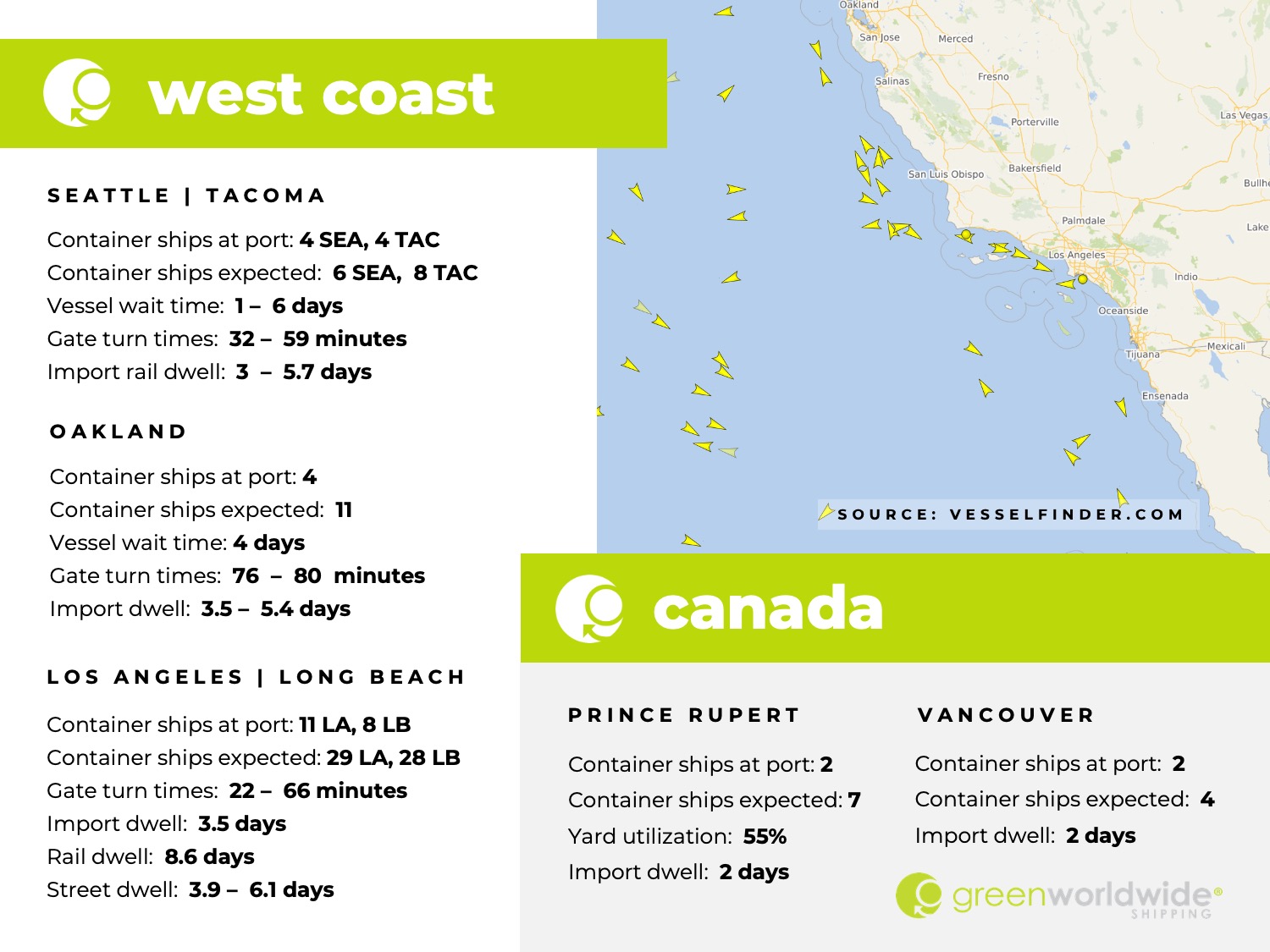

In Week 43, the freight market sees significant U.S. rail congestion, with Los Angeles/Long Beach containers averaging 10-day dwell times and off-dock cargo facing even longer delays. Inland hubs like Chicago and Dallas are also congested due to a railcar shortage, prompting carriers to reduce inbound shipments and shift bookings to alternate ports.

U.S. RAILCAR SHORTAGE STILL IMPACTING USWC PORTS

U.S. rail congestion continues to play a significant role in slowing the flow of cargo. Dwell times in the Los Angeles/Long Beach (LA/LB) area have been averaging 10 days for on-dock containers due to a shortage of railcars, while off-dock cargo is facing even longer delays, with an average of 17 days. In some extreme cases, containers have been sitting for up to 6 weeks before moving on rail.

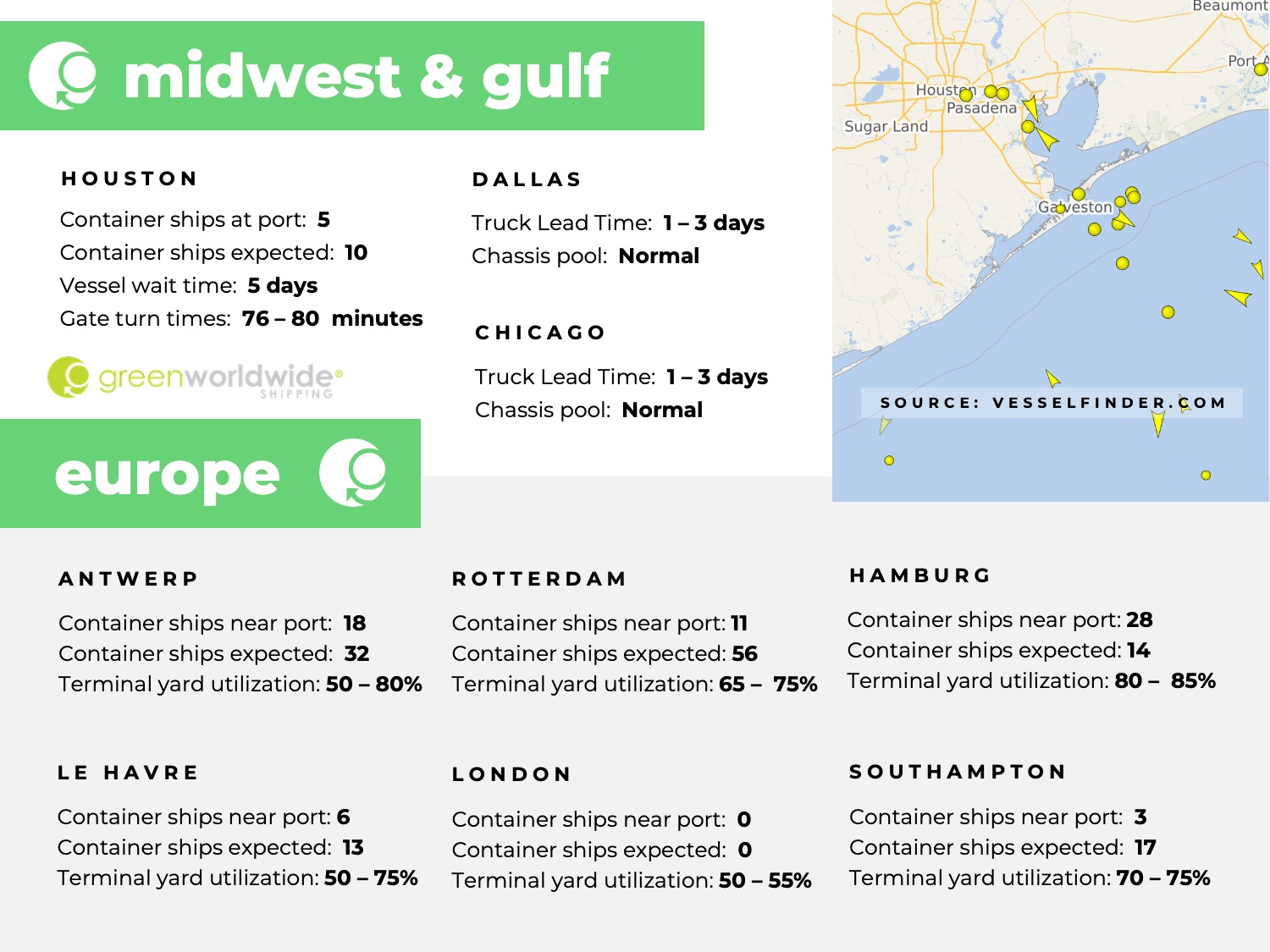

Inland ramps in key locations such as Chicago, Dallas, Kansas City, Memphis, and El Paso are also experiencing congestion due to low railcar availability across the network. This shortage is impacting container movement and causing delays in cargo availability after train arrivals. Some carriers have temporarily reduced inbound flow to the LA/LB port and shifted bookings to alternate ports, with these adjustments expected to last around 7-10 days.

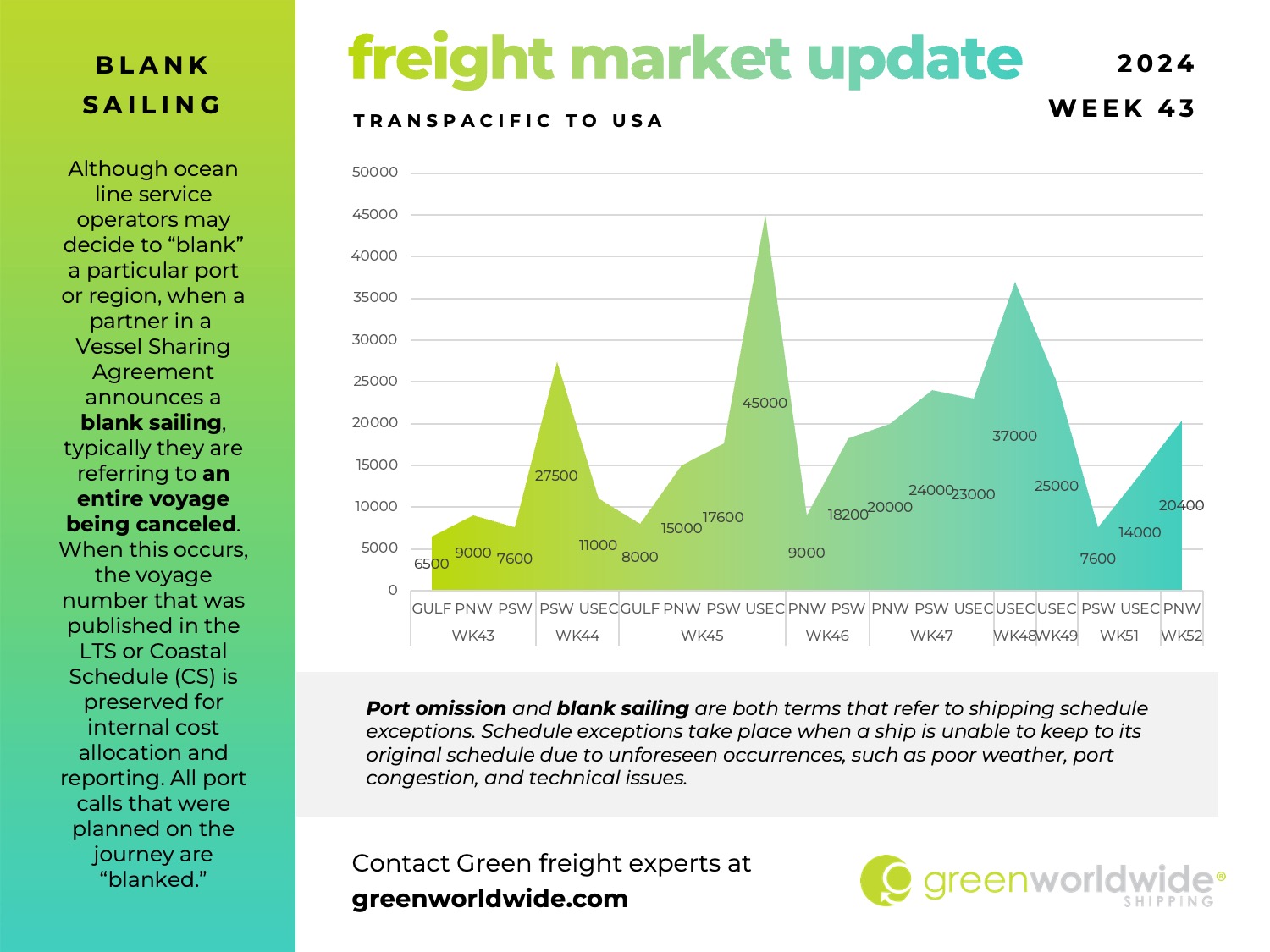

TRANSPACIFIC SEES SERIOUS ROLLING POOL AND PORT BACKLOG

Carriers are facing significant challenges with rolling pools resulting from the heavy backlogs after China’s early October holiday. The capacity for U.S. West Coast (USWC) sailings has tightened considerably, with full vessels and high roll rates. Shipments on Pacific Southwest (PSW) routes are particularly affected, with some experiencing multiple rollovers. Space constraints from China to PSW and inland point intermodal (IPI) destinations continue to intensify, expanding beyond major ports to more origins and side ports across China. Pre-booking space has become essential, with carriers advising a lead time of 3 to 4 weeks.

While PSW and IPI routes remain constrained, the situation is more favorable in Southeast Asia, where supply from Vietnam and Thailand is sufficient, easing pressure on space availability in Seattle.

ILA CONTRACT EXTENSION UPDATE

In a letter, ILA leadershipupdated members on contract talks with USMX. They rejected a 61% wage increase offer due to a no-strike clause, which would have limited action on unresolved issues like job security, work jurisdiction, and healthcare benefits.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.