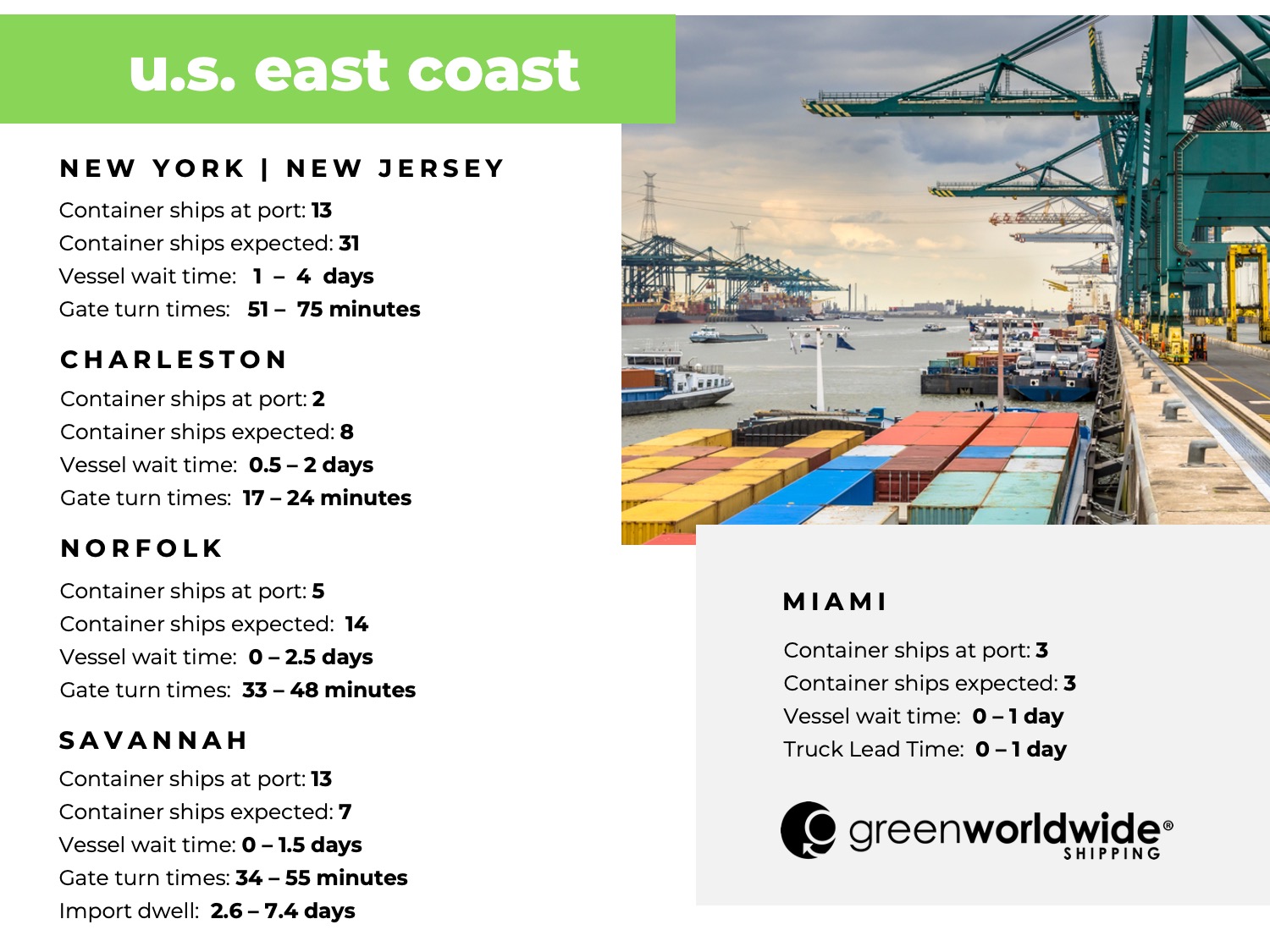

In Week 37, the freight market is recovering from one typhoon and bracing for a hurricane. While capacity softens, some ports in North America remain congested due to order surges and container shortages.

U.S. EAST COAST LABOR STRIKE PENDING

With the ‘no strike’ clause still in effect, job actions are not anticipated before October 1, 2024. Nevertheless, the International Longshoreman’s Association (ILA) has announced plans to strike on this date if negotiators do not finalize a new contract. The union demands include increased wages and stricter automation limits. Negotiations for the USEC have proven more challenging this year compared to previous years. Despite this, shipping lines continue their regular operations from Asia to the USEC. However, some customers are redirecting bookings to the USWC. Should the strike proceed, it could disrupt U.S. supply chains and result in delays that may take weeks to resolve.

CONGESTION WOES PLAGUE NORTH AMERICAN WEST COAST PORTS

Rail container dwell times at certain USWC port terminals have nearly doubled since earlier this summer, driven by heightened import volumes. Carriers caution that rail dwell times and chassis shortages might intensify over the next two months if Southern California’s already congested ports continue to handle additional cargo. This situation is compounded by potential strikes at East and Gulf Coast ports and ongoing rail disruptions in Canada. Currently, LAX/LGB on-dock IPI dwell time averages 9 days. Although improvements are expected in September, a surge in imports from China before the Golden Week holiday could impact this timeline. In Seattle, IPI dwell time has increased to 14 days from 10, mainly due to shifting import volumes from Canada. In Canada, Vancouver’s IPI dwell has improved to 6 days, while PRR remains at 8 days.

TYPHOON CAUSES OPERATIONAL DISRUPTIONS IN ASIA

Typhoon YAGI struck the Philippines earlier last week, causing extensive flooding. The typhoon then made landfall in China’s Hainan at 223 kph and Guangdong at 209 kph on September 6, 2024. It continued to northern Vietnam on September 7. As of now, the death toll in Vietnam has reached 64. Ports in South China, including Yantian, Shekou, and Nansha, along with Hong Kong and Haiphong in Vietnam, are experiencing disruptions. These disruptions include intermittent port closures and flight cancellations, with port operations at Haiphong remaining suspended.

GOLDEN WEEK HOLIDAY

China’s Golden Week, a week-long national celebration, is expected to cause temporary disruptions in global supply chains due to factory shutdowns and reduced workforce availability. During this period, production will slow, and shipments may face delays. While businesses worldwide are likely to encounter some delays, these disruptions are generally short-term. Supply chains typically adjust as operations resume after the holiday.

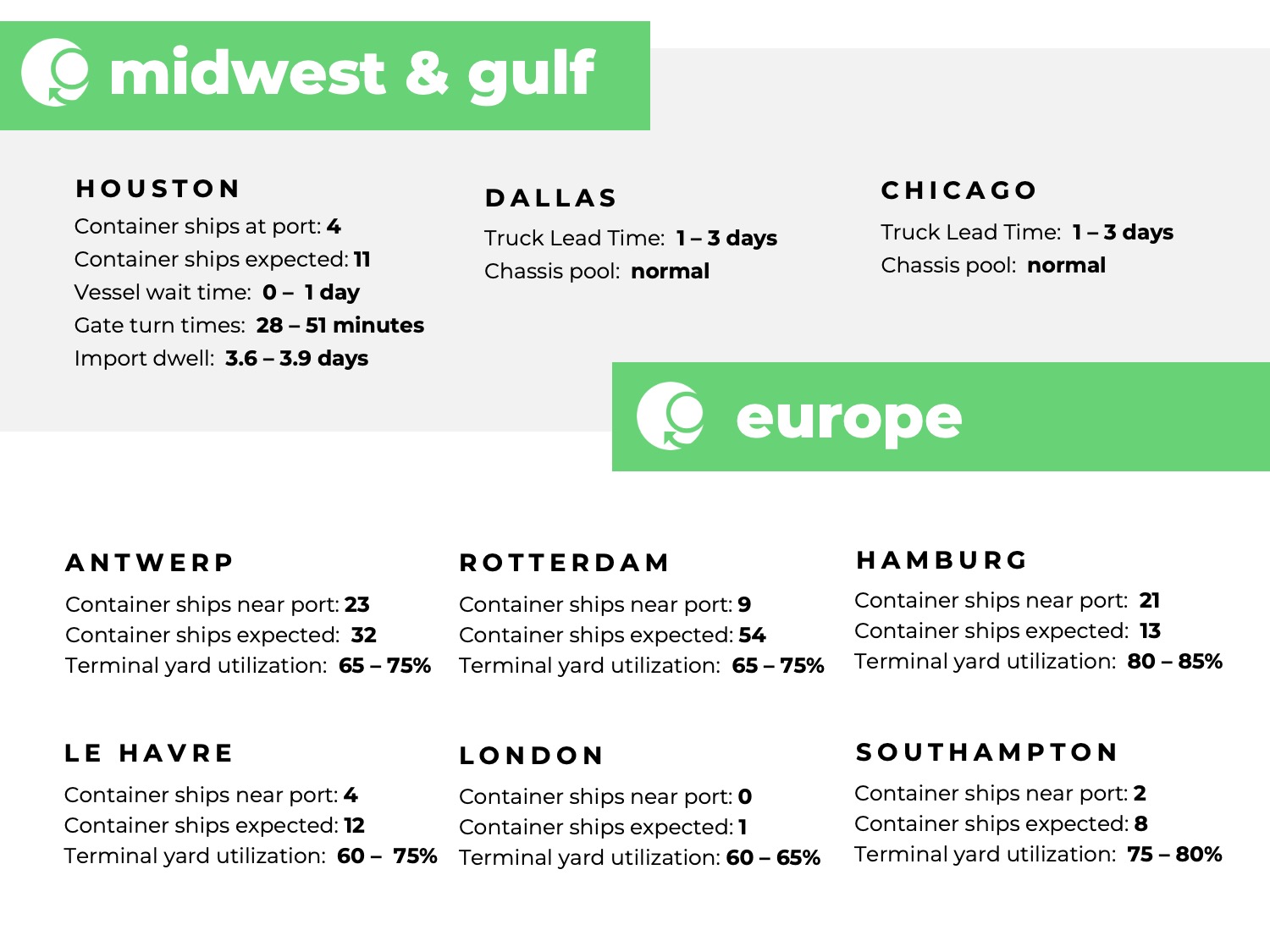

HURRICANE FRANCINE SCHEDULED TO HIT U.S. GULF COAST

Tropical Storm Francine is expected to make landfall in Louisiana as a Category 2 hurricane on Wednesday, September 11, 2024. Life-threatening storm surges, strong winds, heavy rainfall, and flash flooding is expected throughout the Gulf coast including parts of Mexico, and Texas and Louisiana in the U.S. The Port of Houston suspected discharge and vessel operations early on September 10th to prepare for the storm. The port is still allowing trucks to removed already discharged containers. George H.W. Bush Intercontinental (IAH) and Hobby Airports (HOU) began pre-storm efforts. Flights have not yet been impacted but delays and cancellations should be expected in the coming days. The Port of Houston and Houston-area airports resumed normal operations on Wednesday, September 11, 2024.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.