Week 36 finds the global freight market in a state of ongoing turbulence. While shippers prepare for China’s Golden Week holiday, capacity adjustments and port congestion dominate the landscape.

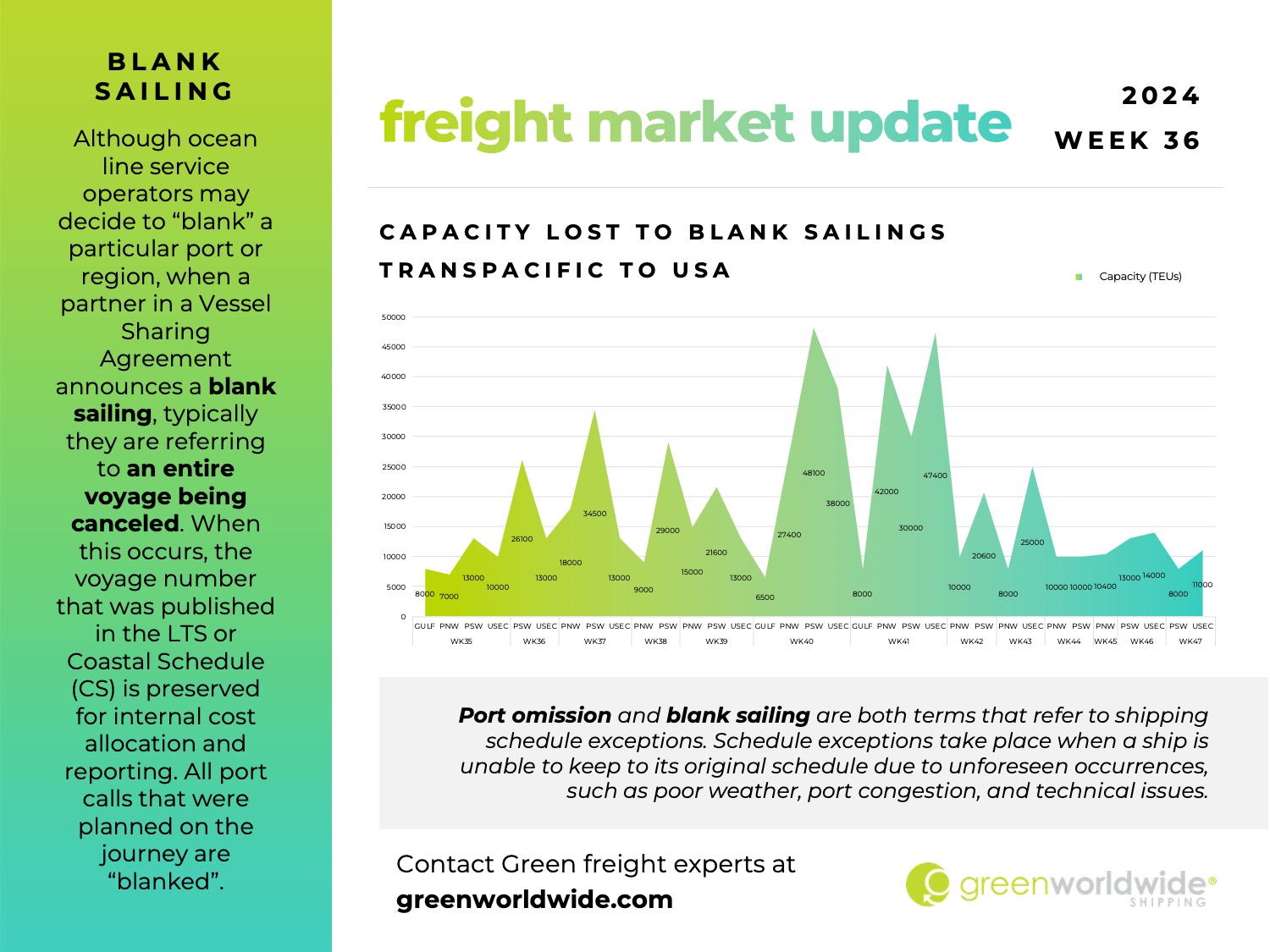

PROJECTION: BLANK SAILINGS TO SPIKE

In advance of China’s Golden Week holiday, in early October, an increase in blank sailings is projected during the traditionally low-demand weeks. Carriers are strategically adjusting capacity to align with weak demand forecasts, particularly for Weeks 40 and 41, when many Chinese factories halt production for up to two weeks in observance of federal holidays. Currently, the notified cancellation rate for scheduled sailings on Pacific Southwest (PSW) lanes ranges between 20% to 25%, while Pacific Northwest (PNW) and U.S. East Coast (USEC) services may see rates escalating to 35% to 40%. With the looming threat of a USEC/GULF port strike in October, additional blank sailings are anticipated in the coming weeks.

USWC PORT CONGESTION

Ports along the U.S. West Coast, including Seattle, Tacoma, Los Angeles, and Long Beach, are experiencing a surge in congestion. This uptick is driven by several factors, including an increase in orders placed ahead of the Golden Week holiday in China and shippers rerouting to the U.S. West Coast due to faltering labor negotiations with port workers on the USEC. The congestion is further exacerbated in Seattle and Tacoma due to ongoing railcar shortages, adding strain to an already stressed supply chain.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.