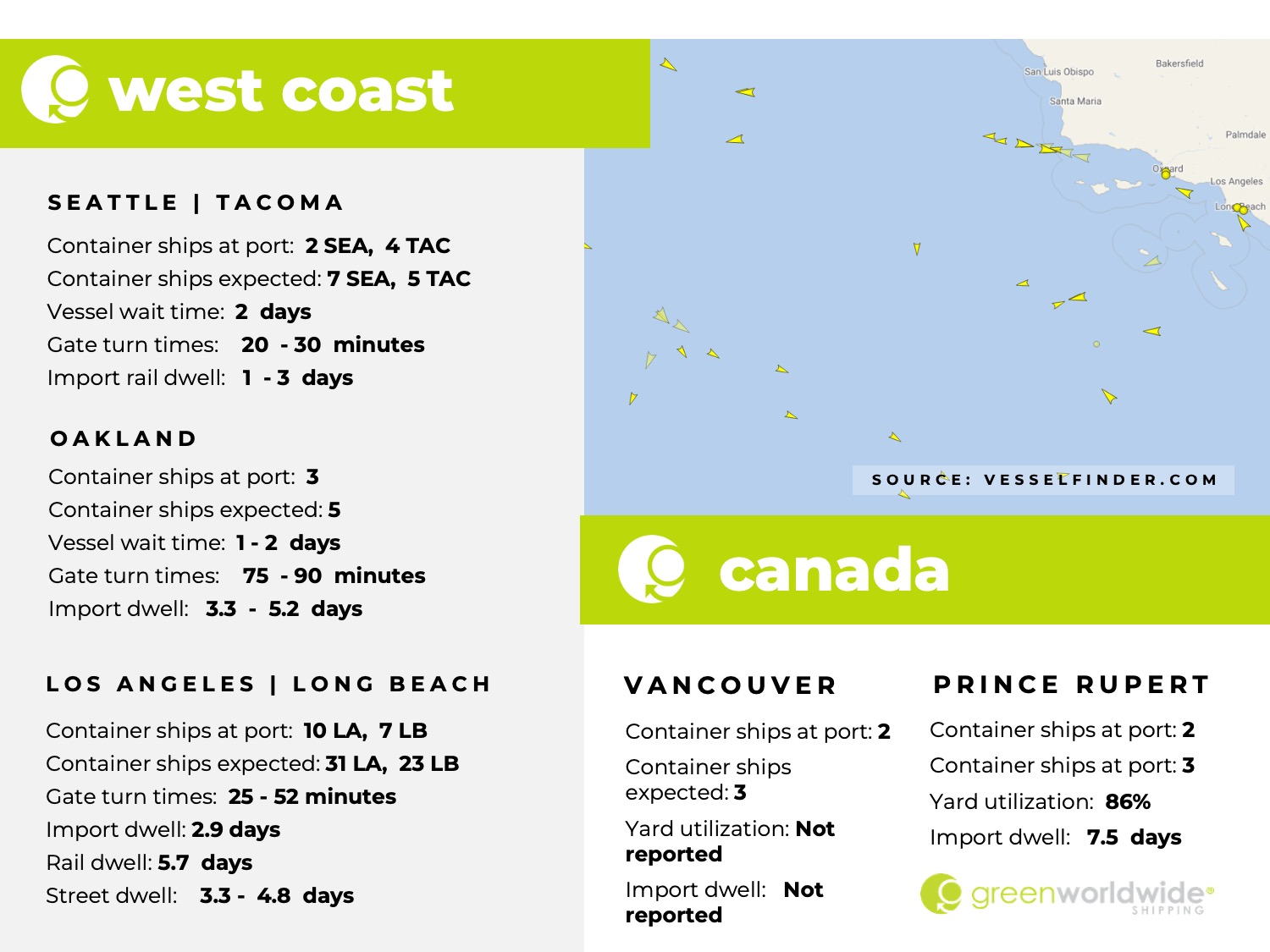

Week 23 ushers in an early start to seasonal demand, vessel congestion woes in some U.S. ports, and increased blank sailings/port omissions.

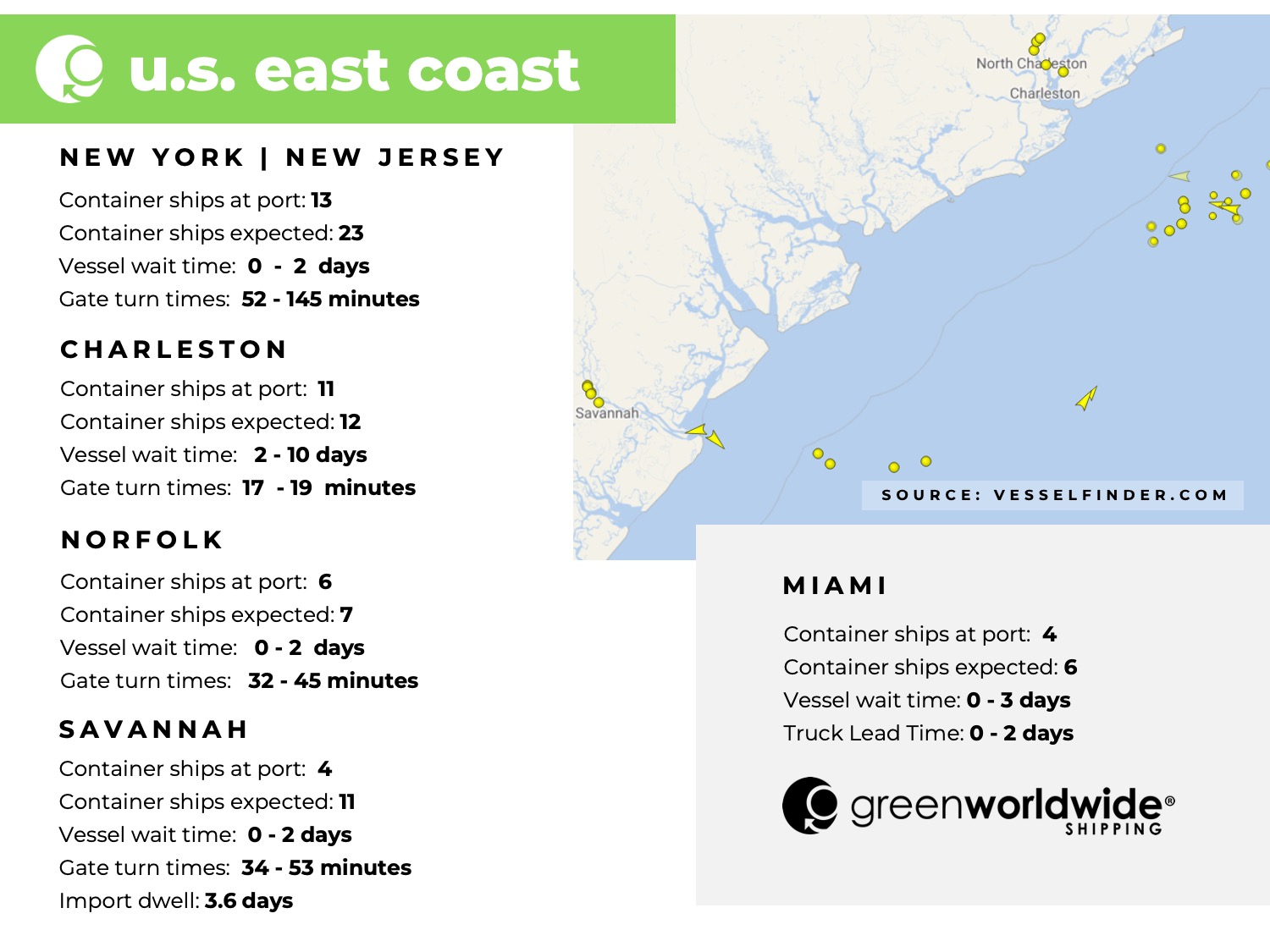

VESSEL CONGESTION GROWS: PORTS OF CHARLESTON & SAVANNAH

South Carolina ports – notably Charleston- halted operations from May 19 – 21, 2024 due to software issues. Lingering effects from the technology malfunction led to growing congestion for vessels awaiting berths at both ports. Confounding the issue is a toe wall project at Charleston that is expected to keep one of Wando Welch’s berths inoperable until the Fall. Several ocean carriers changed their port rotations to stop in Savannah before Charleston to avoid the issues facing South Carolina ports. However, this rotation shift is leading to congestion in Savannah. Both ports will likely see delays until vessel backlogs return to normal levels.

U.S. IMPORTS TRIGGER PRE-SEASON SURGE

U.S. importers are starting peak shipping season early due to concerns about port congestion, potential port worker strikes, and higher tariffs on Chinese-made goods. Increased demand is adding strain to an already congested maritime supply chain. Considerable capacity is being absorbed by service diversions due to the Red Sea crisis and carriers lack enough tonnage to fill the gaps.

PANAMA CANAL

The Canal will implement significant increases in transit capacity, raising the total number of daily transits from 24 to 32. Effective June 1, 2024, an additional slot will become available for the Neopanamax canal.

PORT OF BALTIMORE RECOVERY EFFORTS

Bookings to the Port of Baltimore resumed as limited traffic to the port has been cleared for safe passage.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.