TRANS-PACIFIC SERVICE ADJUSTMENTS GAIN MOMENTUM IN WEEK 16

Carriers on the eastbound trans-Pacific are accelerating service adjustments in response to evolving trade dynamics between China and the United States. As Week 16 begins, a sharp drop in bookings from China drives a wave of blank sailings, suspended port calls, and revised vessel rotations.

POLICY DEVELOPMENTS: EXCLUSIONS CLARIFIED; INVESTIGATIONS UNDERWAY

Recent U.S. trade actions continue to shape sourcing and compliance strategies for importers. On April 11, 2025, the White House clarified product-level exclusions from reciprocal tariffs imposed under Executive Order 14257, including exemptions for electronics such as phones and computers based on HTSUS classification. At the same time, the Department of Commerce launched separate national security investigations under Section 232 to assess risks associated with semiconductor and pharmaceutical imports.

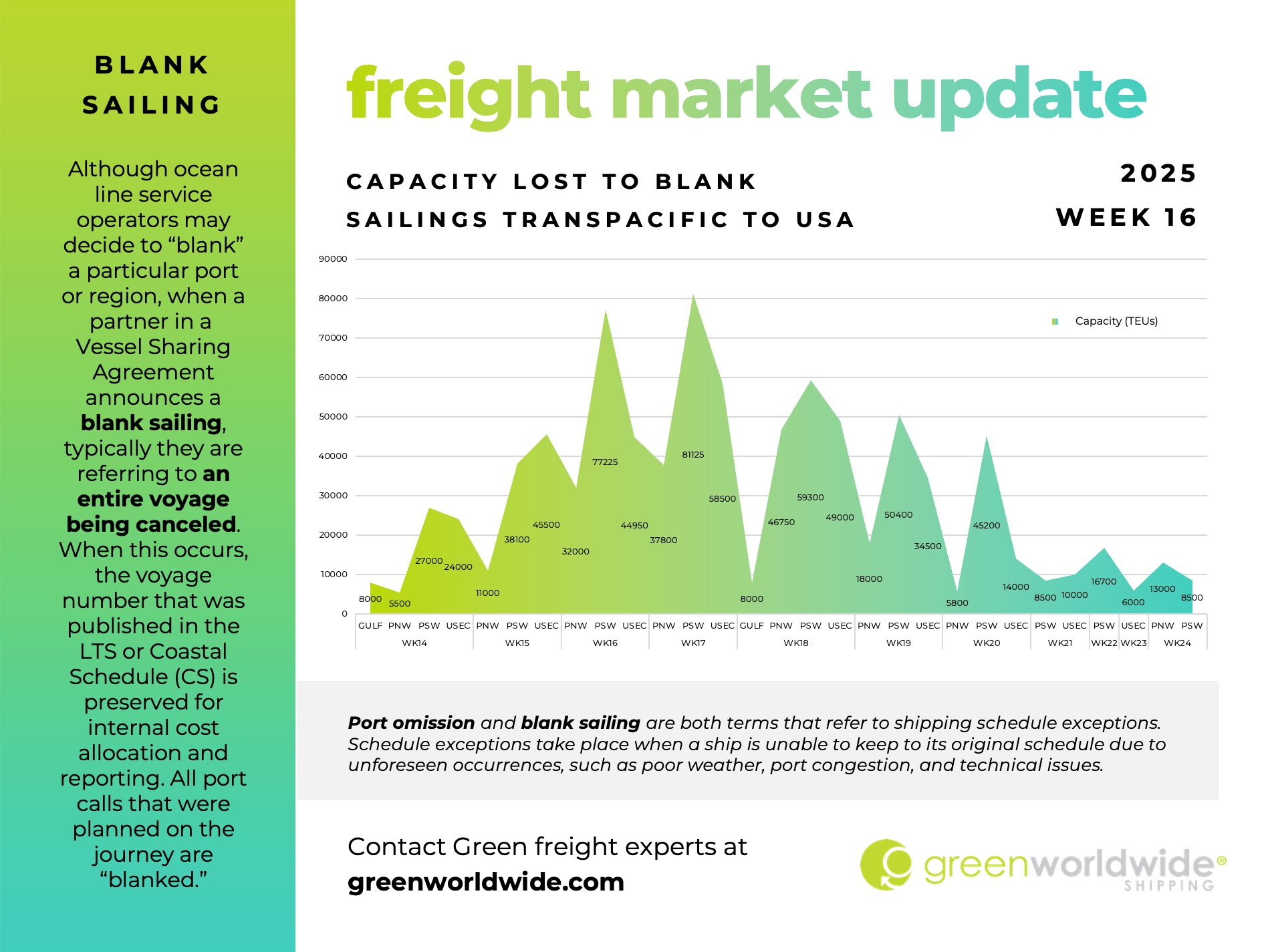

BLANK SAILINGS CLIMB ACROSS PACIFIC SOUTHWEST, PNW, AND EAST COAST ROUTES

Blank sailings have increased sharply across multiple U.S.-bound lanes this week, according to updated schedules. The Pacific Southwest (PSW) leads with 10 cancellations anticipated in Week 17.

Pacific Northwest (PNW) and U.S. East Coast (USEC) lanes continue to anticipate high blank sailing activity into Week 18.

By Week 20, carriers intend to reduce cancellations as they recalibrate vessel deployment to match shifting volumes.

CHINA EXPORTS CONTRACT: CARRIERS SUSPEND ROUTES, DROP PORT CALLS, ADJUST CAPACITY

Export volumes at key Chinese terminals have fallen sharply. Bookings have dropped by over 60% on average, with some ports nearing an 80% decline. In many cases, shippers had already delivered containers to origin terminals before withdrawing bookings—highlighting how quickly market behavior adjusts.

As a result, Ocean Network Express (ONE) has suspended its PN4 service until further notice, pausing earlier plans to resume operations in May. The carrier confirmed that its EC2 service will remove Wilmington from its port rotation beginning in Week 19.

Meanwhile, sourcing shifts continue to support steady or rising volumes out of Southeast Asia and South Asia. Carriers are reallocating capacity to these corridors to accommodate stronger utilization and maintain network fluidity. These tactical shifts reflect a broader effort to align sailing schedules with current volume conditions.

These developments signal continued pressure on sourcing strategies and schedule planning as the trade environment evolves through Q2.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.