Week 15 finds global trade in a flurry of activity as U.S. reciprocal tariffs are in effect, China is enacting countermeasures with multiple new customs regulations introducing more challenging compliance requirements for importers.

RECIPROCAL TARIFFS BEGIN APRIL 5: WIDE-RANGING DUTIES NOW IN FORCE

On April 5, 2025, the United States implemented a baseline 10% tariff on all imports from countries not party to the USMCA. A second tier of reciprocal tariffs goes into effect April 9, targeting more than 60 countries identified for trade imbalances or currency practices. Tariff rates vary by country, with key U.S. sourcing partners—including China (34%), Vietnam (46%), Thailand (37%), and the European Union (20%)—now subject to substantial duty increases.

Exemptions apply to certain commodity categories, including pharmaceuticals, semiconductors, energy products not produced domestically, and items already under Section 232 enforcement. USMCA-origin goods continue to receive preferential treatment, while non-compliant goods are subject to 25% or 10% tariffs depending on classification.

CHINA RETALIATES WITH 34% TARIFF ON U.S. IMPORTS AND EXPORT CONTROLS

Effective April 10, China will impose a 34% tariff on all U.S.-origin imports. The State Council Tariff Commission confirmed that shipments departing before April 10 and arriving before May 13 will be exempt. Export license requirements have been enacted for select medium and heavy rare earth elements, alongside new restrictions targeting 27 U.S. entities operating in the electronics, aerospace, and clean energy sectors.

These developments raise concerns over longer lead times, elevated sourcing costs, and increased documentation requirements for U.S. manufacturers dependent on Chinese-sourced rare earth materials and dual-use components.

In response, President Donald Trump issued a public statement warning that, should China proceed with its retaliatory tariffs, the United States may impose an additional 50% tariff on top of all existing duties targeting China-based goods. The statement also indicated that ongoing U.S.-China trade discussions would be suspended, while engagement with other trade partners would be prioritized.

DE MINIMIS EXEMPTIONS END MAY 2 FOR CHINA AND HONG KONG

Beginning May 2, all shipments from China and Hong Kong—regardless of value—must undergo standard U.S. Customs entry procedures.

The change eliminates the $800 de minimis exemption for low-value shipments and requires:

-

- Tariff classification and full duty payment

- Entry submission via ACE (Automated Commercial Environment)

- Bond posting and remittance in accordance with CBP regulations

Postal carriers will be required to remit duties monthly and choose between two consistent duty assessment methods:

-

- 30% ad valorem per item

- Flat rates of $25/item (May) and $50/item (June onward)

Cultural and informational goods such as books, films, and photographs remain exempt under IEEPA provisions.

SECTION 232 AUTO TARIFFS NOW ACTIVE; AUTO PARTS NEXT

As of April 3, 25% tariffs now apply to certain imported passenger vehicles and light trucks under specified HTS subheadings, which must be declared under HTS 9903.94.01. Vehicles 25 years or older are exempt.

On May 3, the second phase of enforcement will expand to cover a wide range of auto parts spanning Chapters 40, 70, 73, 83, 84, 85, 87, 90, and 94 of the U.S. Harmonized Tariff Schedule. USMCA-origin auto parts remain temporarily exempt until formal exemption procedures are published in the Federal Register by CBP and the Commerce Department.

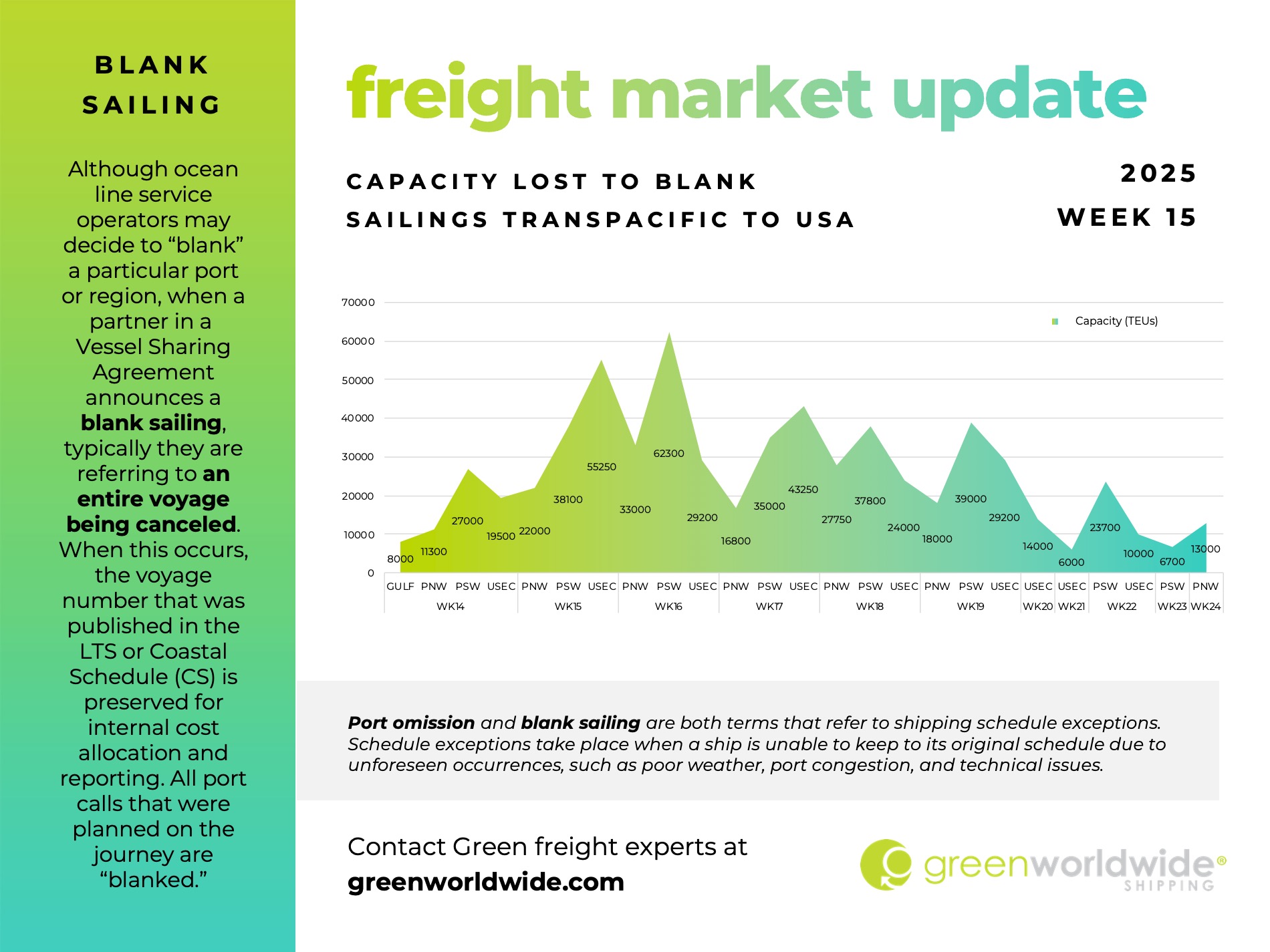

OPERATIONAL IMPACTS: SOURCING STRATEGIES AND BOOKING SHIFTS UNDER REVIEW

Widespread uncertainty surrounding tariff enforcement timelines, reciprocal duty thresholds, and content-origin rules is prompting importers and manufacturers to adopt a more cautious, contingency-based approach. Supply decisions that might have once been routine are now being re-evaluated for compliance risk, duty exposure, and long-term resilience.

Forwarders throughout Asia are reporting increased volatility in booking patterns, with urgent bookings front-loaded to beat tariff deadlines and a wave of last-minute cancellations as trade lanes are reassessed. Some shipments have been rerouted through transshipment hubs with more favorable duty status, adding pressure on documentation teams tasked with managing revised declarations and bonded warehouse transfers.

Labor-intensive industries such as textiles, toys, footwear, and small electronics remain particularly vulnerable. For many of these categories, margin constraints limit flexibility, leaving importers to choose between absorbing the new duties, renegotiating prices, or shifting production—a decision matrix that varies significantly by volume, velocity, and shelf life.

WEBINAR: NAVIGATING THE NEW U.S. RECIPROCAL TARIFF POLICY

Join Green Worldwide Shipping for a live webinar on Thursday, April 10, 2025 at 1PM EST. We will provide you some tools to help you navigate the new U.S. reciprocal tariff framework and its impact on global supply chains. This session will examine duty structures, country-specific measures, and compliance strategies for importers, exporters, and logistics professionals.

Topics include:

- Overview of the tariff system and key implementation dates

- Exemptions, USMCA provisions, and Customs documentation requirements

- Mitigation strategies and trade outlook

Registration is free but required. Reserve your spot today for this helpful approach to understand how these new tariffs and countermeasures may impact your supply chain.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.