Week 13 finds new U.S. tariffs, strained European port operation, and transatlantic trade lane service suspensions creating additional challenges to a strained global network.

NEW 25% SECONDARY TARIFF ON TRADE LINKED TO VENEZUELAN OIL EFFECTIVE APRIL 2, 2025

A new U.S. executive order will impose a 25% tariff on all goods imported from countries purchasing Venezuelan oil, either directly or through third parties, starting April 2, 2025. This “Secondary Tariff” expands the scope of recent trade enforcement actions.

-

Applies in addition to existing tariffs under IEEPA, Section 232, and Section 301.

-

The Secretary of State will determine which countries are subject to the tariff. If applied to China, it will extend to Hong Kong and Macau.

-

The tariff remains in effect for 12 months after the country’s last qualifying Venezuelan energy transaction.

All U.S. Importers – especially those sourcing goods from China, Singapore, Malaysia, Vietnam, and the Dominican Republic – are encouraged to evaluate exposure, monitor compliance risk, and consult with Customs brokers. As of March 25, 2025, no Federal Register notice or formal CBP guidance has been issued.

SERVICE SUSPENSIONS: ASIA–U.S. EAST COAST TRANSATLANTIC TRADE LANES IMPACTED

In response to shifting market conditions and alliance restructuring, carriers have announced key service suspensions that affect direct capacity into the U.S. East Coast. These changes are particularly relevant for shippers with volume allocations tied to suspended loops:

-

TSL AWC2 – Suspended effective April 1, 2025 until further notice

-

COSCO AWE7 – Suspended beginning with the CMA CGM LA TRAVIATA 065E (ETD April 1); service expected to resume June 2025

-

CMA CBX – Confirmed as suspended

EUROPEAN PORT CONGESTION ESCALATES WITH SERVICE REALIGNMENTS

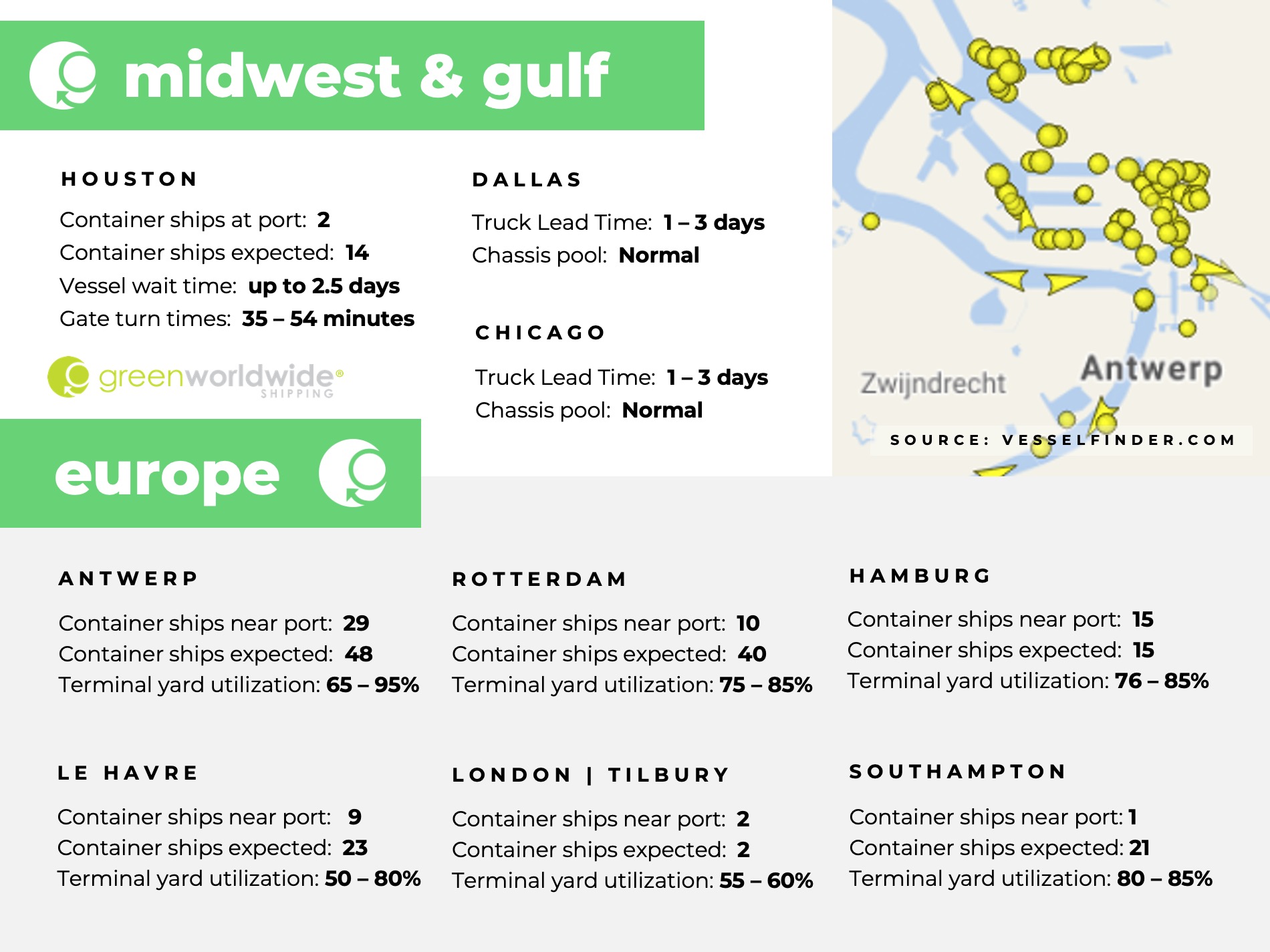

As ocean carriers roll out new alliance structures, Europe’s largest ports are experiencing operational stress. Parallel vessel rotations—combining legacy and new services—have extended berth wait times, constrained yard capacity, and slowed inland flows.

-

Rotterdam: Average berth delays now exceed 5.6 days. Yard utilization remains near full, with lingering backlog effects from recent labor unrest.

-

Antwerp: Restrictions on empty container returns are reducing inland connectivity and slowing cargo velocity.

-

Hamburg and Le Havre: Labor-related slowdowns continue to impact vessel turnaround times.

These congestion issues are placing downstream pressure on Asia–Europe and Transatlantic lanes, with disruptions expected to continue into Q2 as alliance transitions unfold.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.