GLOBAL TRADE SHIFTS AND FREIGHT DISRUPTIONS IMPACT SUPPLY NETWORKS

New U.S. trade measures are now in effect, with higher tariffs on China, Hong Kong, Canada, and Mexico in place since March 4, 2025, and expanded Section 232 tariffs on steel and aluminum taking effect March 12, 2025. The latest policy changes are prompting global countermeasures, while additional fees on Chinese-built vessels are under consideration.

At the same time, freight disruptions continue in Europe, as a nationwide aviation security strike in Germany on March 10, 2025, led to more than 1,000 flight cancellations at Frankfurt, Munich, and Hamburg airports, impacting both passenger and cargo operations. Meanwhile, Transpacific demand remains weak, and carriers are scaling back capacity, increasing blank sailings to stabilize rates amid shifting trade dynamics.

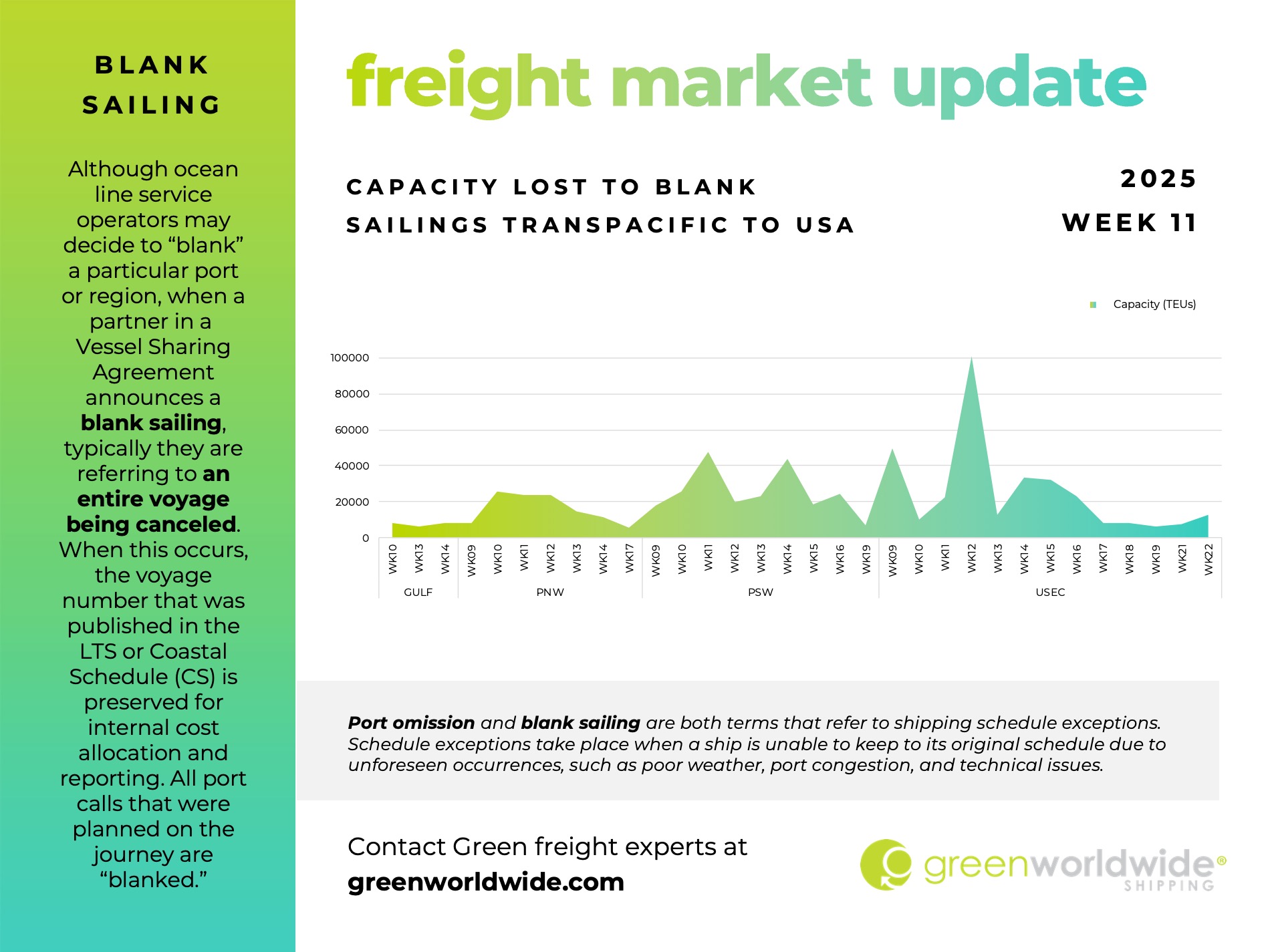

TRANSPACIFIC CAPACITY OUTLOOK: CARRIERS PULL BACK AS DEMAND LAGS

Transpacific volume recovery remains sluggish, failing to gain momentum post-Chinese New Year. Despite factories in China ramping up production in mid-February, shippers are reducing orders amid tariff concerns, keeping bookings below expectations.

In response, carriers are scaling back capacity, increasing blank sailings to match weaker demand. PNW services are expected to drop to 66% in Week 12 and to just 60% by Week 16. On the USEC trade, capacity will likely fall to 80% in Week 13, hold at 90% in Week 14, and slip to 77% by Week 16.

With soft demand, carriers are tightening space to stabilize load factors. The coming weeks will determine whether market conditions shift—or if deeper capacity cuts are ahead.

SECTION 232 TARIFFS ON STEEL AND ALUMINUM TAKE EFFECT

On March 12, 2025, the U.S. expanded Section 232 tariffs, applying a 25% duty on all steel and aluminum imports, including derivatives. The updated enforcement eliminates previous country-specific exclusions, broadening the scope of affected shipments.

The new tariffs apply to 19 aluminum derivative subheadings and 157 steel derivative subheadings, covering a range of industrial applications. The Commerce Department has confirmed that steel and aluminum derivatives previously exempt under trade agreements—such as those from Canada, Mexico, and the EU—will now be subject to tariffs.

EU, CANADA, AND CHINA RESPOND WITH NEW TARIFFS

Trade partners have introduced their own measures in response. Canada’s $155 billion response includes tariffs on U.S. beer, wine, bourbon, home appliances, and Florida orange juice. Meanwhile, China has applied up to 15% tariffs on U.S. agricultural exports, expanded export controls, and introduced new restrictions on select U.S. companies. Mexico has also implemented tariffs on key U.S. exports, with further details outlined in trade filings.

The European Union has announced new 25% tariffs on $28.4 billion (€26 billion) worth of U.S. goods, rolling out in two phases:

- April 1, 2025 – Reintroduction of previously suspended tariffs on $4.9 billion (€4.5 billion) in U.S. goods.

- Mid-April 2025 – Additional duties on $19.6 billion (€18 billion) in U.S. exports after EU consultations.

USMCA IMPACTS: NAVIGATING NORTH AMERICAN TRADE SHIFTS

With higher duties on Canadian and Mexican imports, shippers are weighing how these measures interact with USMCA trade agreements. While USMCA aims to facilitate duty-free trade, not all goods qualify for exemptions. CBP has clarified that certain USMCA-qualifying goods, including autos and select merchandise, will receive a temporary tariff delay until April 2, 2025, after which enforcement will begin.

Meanwhile, key Chapter 98 tariff provisions remain in place, including:

- U.S. goods exported and returned from Canada/Mexico, even if containing foreign-origin materials.

- Repairs, alterations, and assembly of U.S. components abroad, with tariffs applied only to the value-added portion.

- Donations of food, clothing, and medicine designated for humanitarian relief.

Importers must ensure compliance with Rules of Origin requirements, and CBP is expected to intensify enforcement of classification, valuation, and documentation requirements.

GERMAN AIRPORT STRIKE DISRUPTS AIR CARGO MOVEMENTS

A 24-hour labor strike at 13 major German airports on March 10, 2025, caused widespread flight cancellations and cargo handling delays at key freight hubs, including Frankfurt and Leipzig/Halle. The walkout follows weeks of European port disruptions, further tightening capacity for time-sensitive shipments.

While the strike was a one-day action, union leaders have warned of potential additional labor disruptions if contract negotiations remain unresolved. The next round of talks is set for March 26–27, 2025.

USTR PROPOSES NEW FEES ON CHINESE-BUILT VESSELS

The U.S. Trade Representative (USTR) has introduced a proposal targeting Chinese maritime operators with service fees of up to $1.5 million per vessel entrance. The policy applies to carriers based on fleet composition, vessel origin, and future shipbuilding orders, with those operating 50% or more Chinese-built vessels facing penalties up to $1 million per port call.

In addition, the plan seeks to increase U.S.-flagged vessel utilization, mandating that a growing percentage of U.S. goods be shipped on U.S.-built and U.S.-operated vessels over the next seven years. Fee remissions are possible for operators using U.S.-built ships, but the policy is expected to influence cargo routing, vessel deployment, and overall service availability.

ADDITIONAL U.S. AND GLOBAL TRADE COMPLIANCE RESOURCES

For a full analysis of trade policy changes and compliance strategies, watch our recent U.S. Tariff & Trade Policy Update webinars:

- March 10 Webinar: U.S. Tariff & Trade Policy Update for Mexico, Canada, China, Hong Kong, Section 232 & More

- February 6 Webinar: Canada, Mexico, China Tariff Impact for U.S. Shippers & Supply Chains

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.