FREIGHT VOLUMES REMAIN BELOW PRE-HOLIDAY LEVELS

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.

Market activity remains subdued, though a slight improvement over the previous week has pushed volumes to approximately 40% of pre-Lunar New Year levels. However, weak demand and the impact of new tariff policies continue to restrict a full recovery. With limited signs of a near-term rebound, carriers are adjusting capacity strategies in response to the softened market conditions.

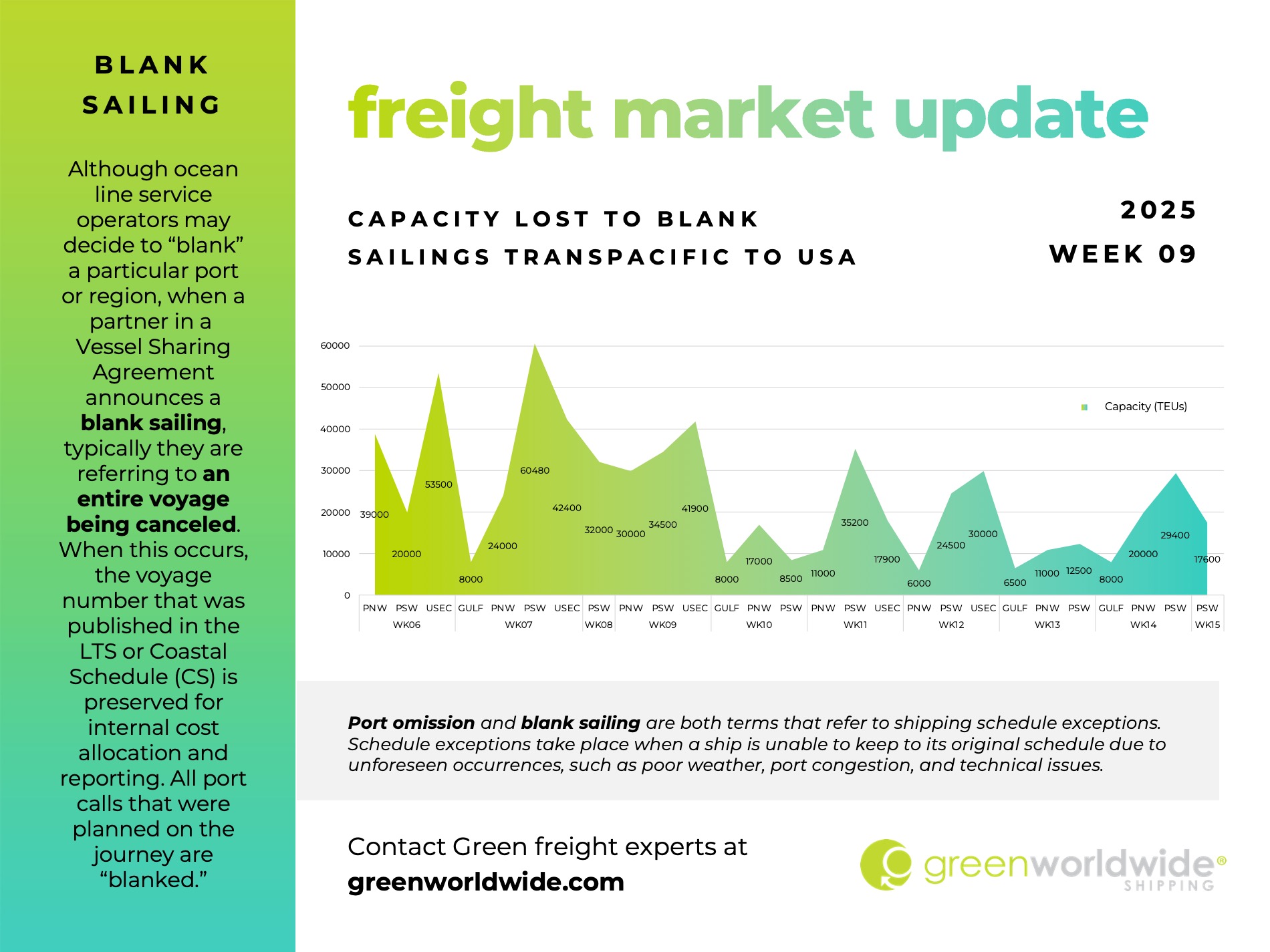

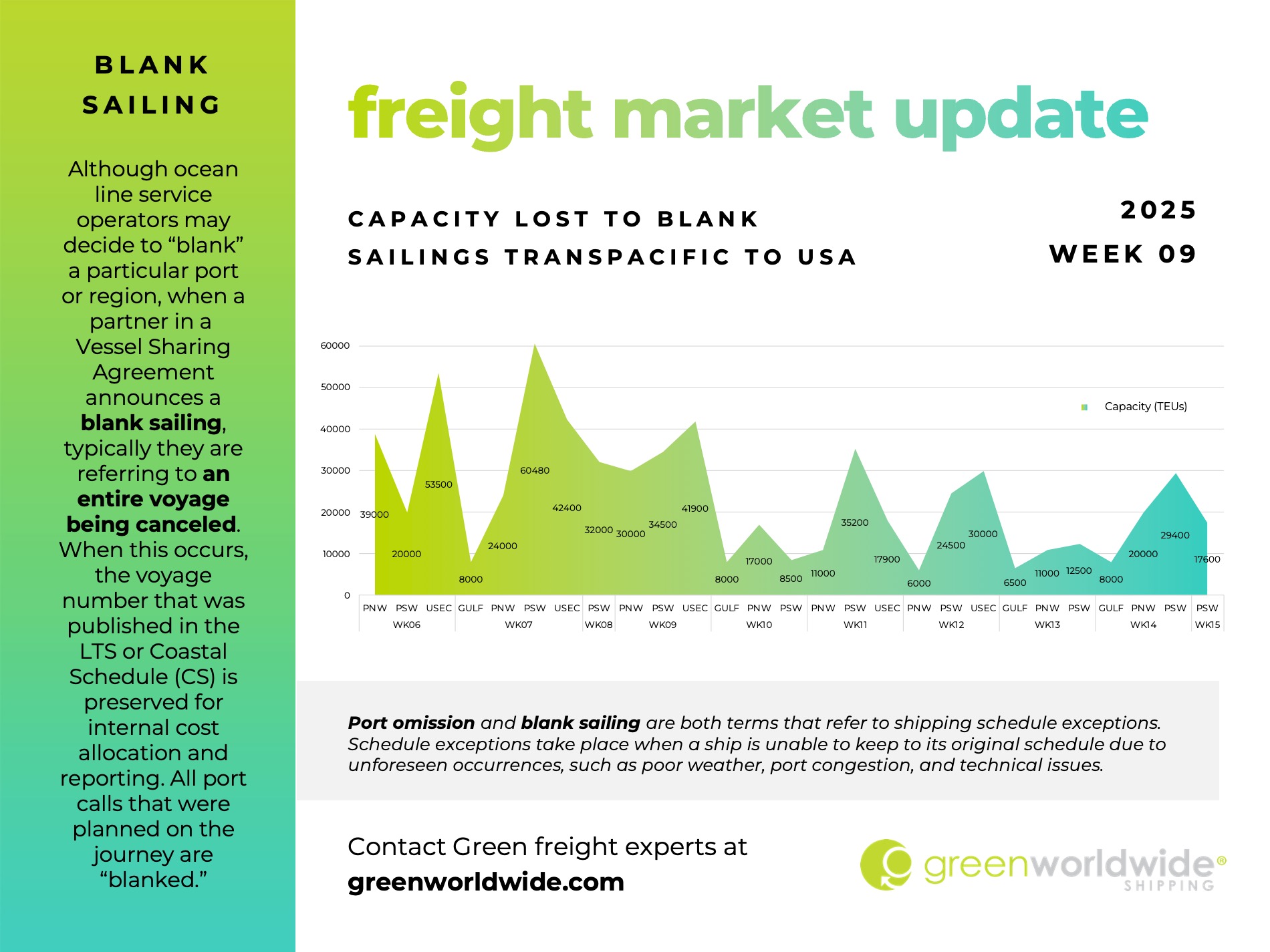

In response to softened market conditions, carriers are implementing schedule adjustments to align capacity with current demand levels. A series of blank sailings are planned from mid-March through the end of April, strategically reducing available sailings in anticipation of shifting volume patterns. These adjustments come as the 2025-2026 contract season approaches in May, with carriers looking to maintain balanced vessel utilization and prevent further disruptions in service reliability.

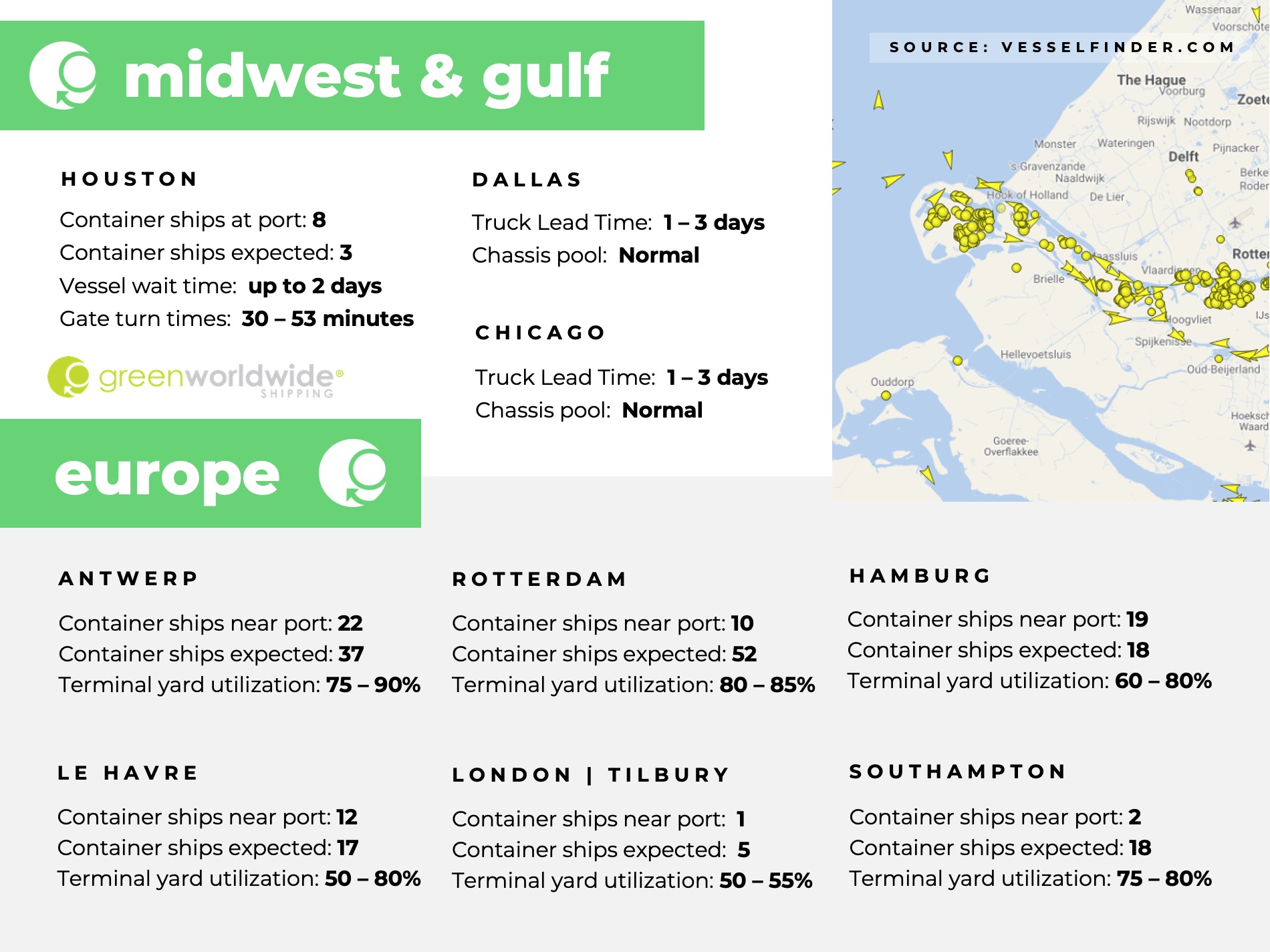

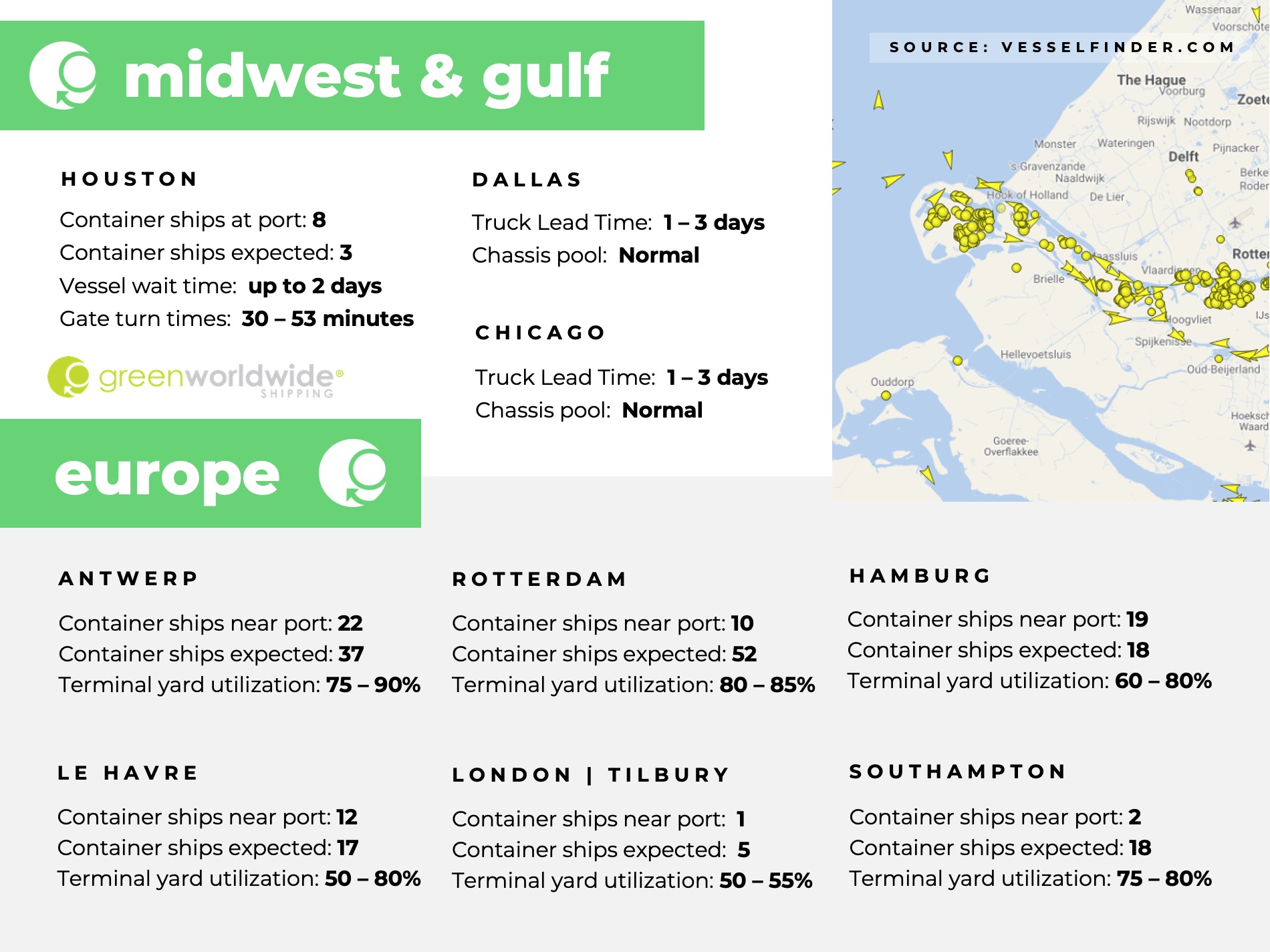

Ongoing labor strikes at Rotterdam’s Delta II terminal are disrupting vessel operations, with union FNV Havens urging European dockworkers to refuse handling diverted cargo. Meanwhile, rolling strikes at French ports, including Le Havre, continue, with a nationwide 48-hour stoppage planned for February 26–28. The combination of labor actions and rising import volumes from Asia is straining regional capacity, with barge wait times averaging 76 hours in Rotterdam and 84 hours in Antwerp. As congestion worsens, the potential for broader labor disruptions remains a growing concern.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.