FREIGHT MARKET OUTLOOK: VOLUME REBOUND DELAYED UNTIL MID-MARCH

With Week 07 underway, the freight market remains in flux, experiencing soft demand following the Lunar New Year holiday. Uncertainty with U.S. trade actions is creating shifts in seasonal bookings, while new carrier alliances are restructuring capacity across various trade lanes. The volume rebound is expected to take until mid-March due to a combination of production delays, booking hesitancy, and shifting capacity dynamics.

POST-LUNAR NEW YEAR PRODUCTION LAG

Cargo volumes are slow to rebound as only 75% of key suppliers have resumed operations, and many factories won’t restart full production until after the Lantern Festival on February 12, 2025, due to raw material shortages. Historically, post-Lunar New Year demand ramps up gradually, and with current disruptions, this year’s recovery is expected to extend into early to mid-March.

TARIFF UNCERTAINTY

Shippers are postponing bookings as they assess the impact of recent U.S. trade actions. On February 10, 2025, the White House reinstated a 25% tariff on steel imports, eliminating previous exemptions and alternative agreements with key trade partners. This move follows last week’s U.S. tariffs on China, Canada, and Mexico and is intended to curb rising import volumes, address global overcapacity, and support domestic steel production. As a result, some businesses are evaluating supply chain shifts to alternative sourcing regions such as Taiwan, Southeast Asia, and India, adding further uncertainty to short-term freight demand.

CARRIER ALLIANCE RESHUFFLING INCREASING CAPACITY

The realignment of global carrier alliances is introducing additional capacity into the trans-Pacific market, exacerbating overcapacity concerns. As carriers reposition services and compete for customers, network stability will take time to settle.

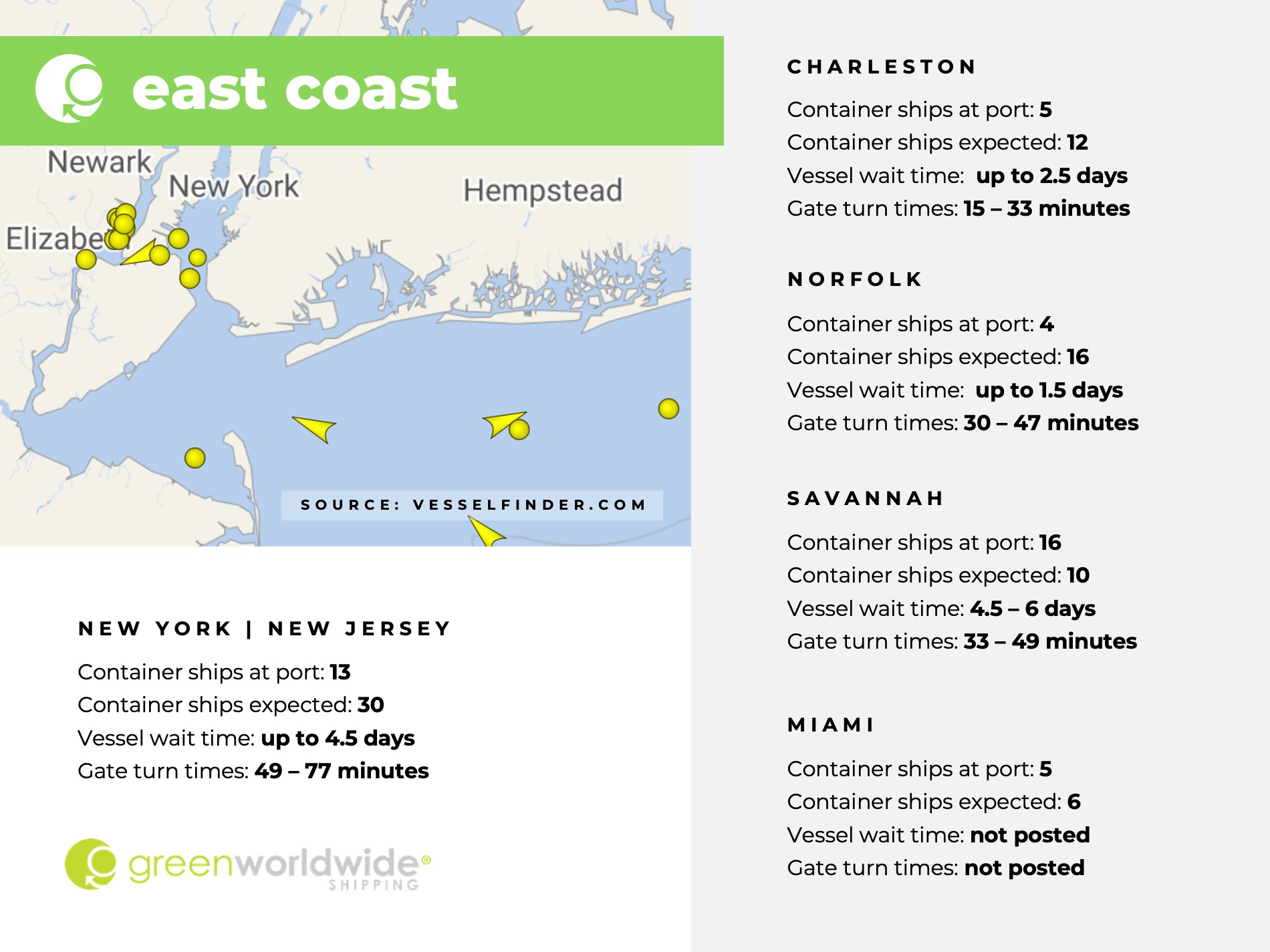

REGIONAL TERMINAL CONGESTION: NEW YORK/NEW JERSEY

Terminal congestion in New York/New Jersey is a significant challenge, affecting carriers, terminals, depots, truckers, and customers due to high import volumes, service shifts, severe weather, and labor uncertainties.

To alleviate equipment imbalances, some carriers are deploying additional vessels over the next few weeks, with at least 17,000 TEUs of empty equipment expected to be evacuated between Weeks 7-9, followed by 2,500 TEUs per week thereafter. Off-site depots are also being considered as an alternative for empty returns. While these measures do not immediately resolve space constraints, coordinated industry-wide efforts should help increase empty return capacity in the coming weeks. In the interim, free time extensions and chassis relief measures will be implemented to mitigate delays.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.