WEEK 1 FREIGHT MARKET UPDATE: A STRONG START TO 2025 EXPECTED, BUT CHALLENGES AHEAD

The freight market is kicking off 2025 with strong demand and several key developments shaping how global shipping will unfold in the coming weeks. While there is a lot of momentum right now, there are also some challenges on the horizon that shippers and carriers need to monitor.

STRONG DEMAND DRIVES EARLY-YEAR ACTIVITY

China’s ports have seen significant growth in container throughput over the past couple of weeks, with double-digit increases in volume. This boost comes as shippers are front-loading orders ahead of potential U.S. tariff changes under the new administration. Ports like Los Angeles, Long Beach, and Oakland have already hit record volumes, and the usual pre-Lunar New Year rush is adding even more pressure. We expect this strong demand to continue through late January.

CHINESE NEW YEAR FACTORY CLOSURES

Here’s what we’re seeing with Chinese suppliers:

- 60% will begin their holidays in Week 4, which is one week before the official start of the holiday on January 28.

- 20% will close right on January 28, and another 20% will begin their break earlier in Week 3.

- Most suppliers (60%) plan to return to work in Week 7, while 35% will be back immediately after the holiday ends on February 4.

This means that while we may see a bit of a dip in volumes around the Chinese New Year period, the drop won’t be as sharp as expected. February could see slower booking activity due to factory shutdowns, but things should pick up by the end of the month.

KEY DATES IN EARLY 2025

- January 15: The temporary suspension of the ILA port strike ends, and we could see disruptions if no new agreement is reached.

- January 20: U.S. Inauguration Day, and with it, an expected implementation of new tariffs.

- January 28: Chinese New Year begins, triggering widespread factory shutdowns in China.

- February 1: The GEMINI and PREMIER shipping alliances launch, which will impact vessel schedules and capacity.

CAPACITY AND OPERATIONAL SHIFTS

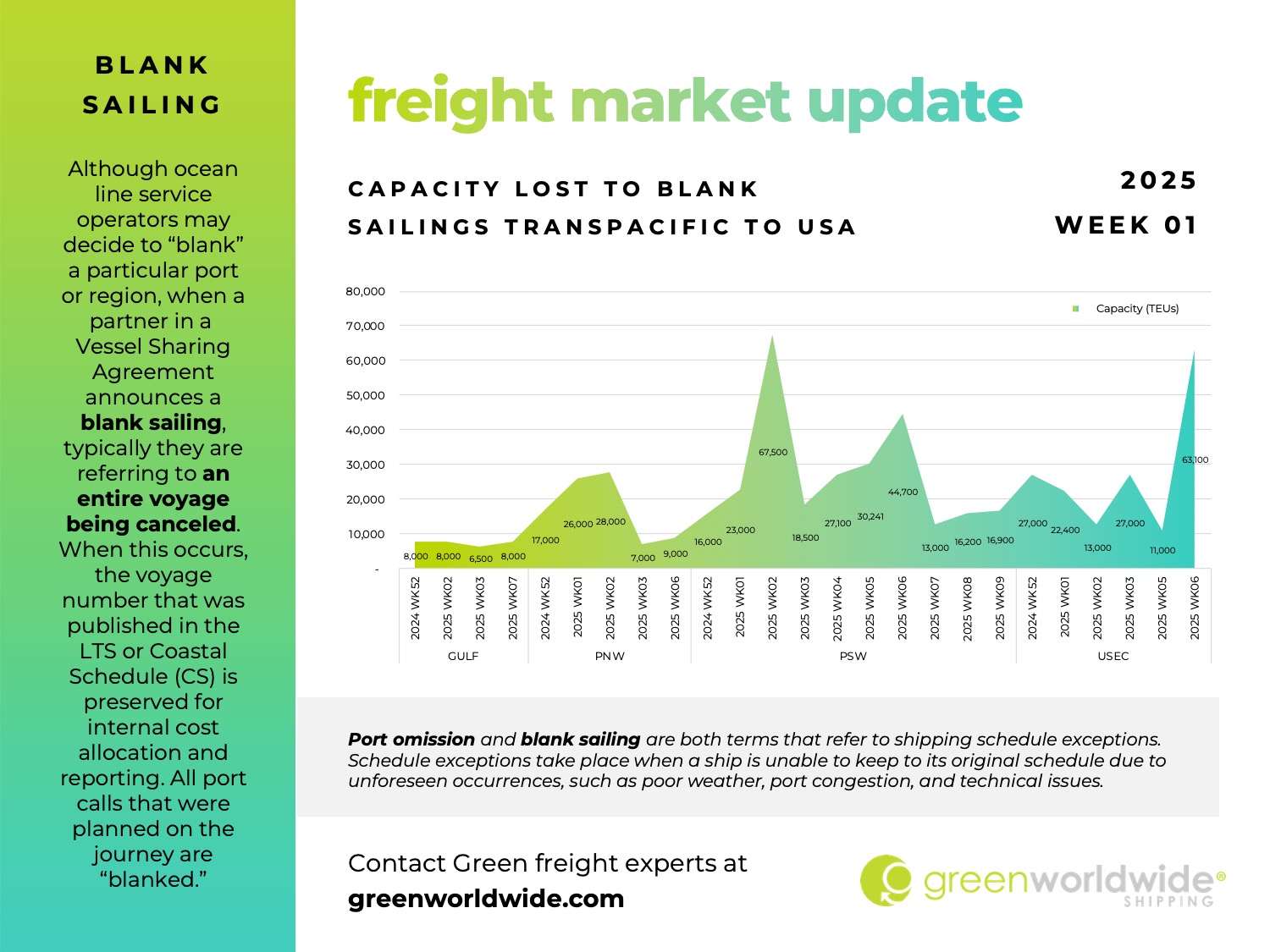

The launch of the GEMINI (Maersk and Hapag) and PREMIER (ONE, YML, HMM) alliances on February 1 is expected to temporarily take significant capacity out of the market while shipping lines reconfigure their operations. This will result in:

Blank sailings and delays:

-

- PSW Services: Blanked sailings in Weeks 1 and 5, with some delays in Weeks 2 and 3.

- PNW Services: Capacity downgrades in Week 4 and blank sailings in Weeks 4 and 5.

Hub-and-Spoke Strategy: GEMINI’s plan to use more feeder vessels will put pressure on transshipment hubs, potentially leading to further delays and inefficiencies.

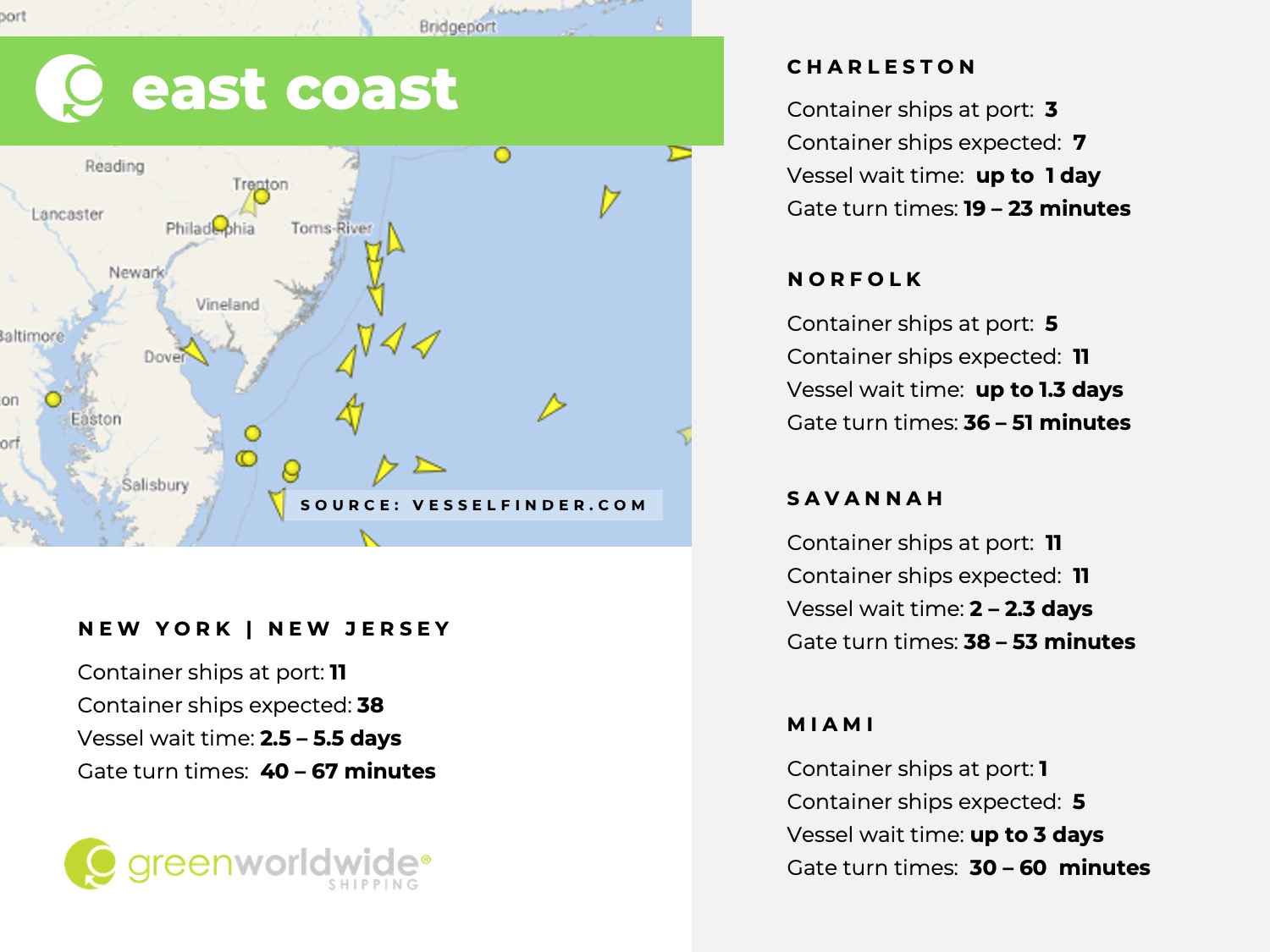

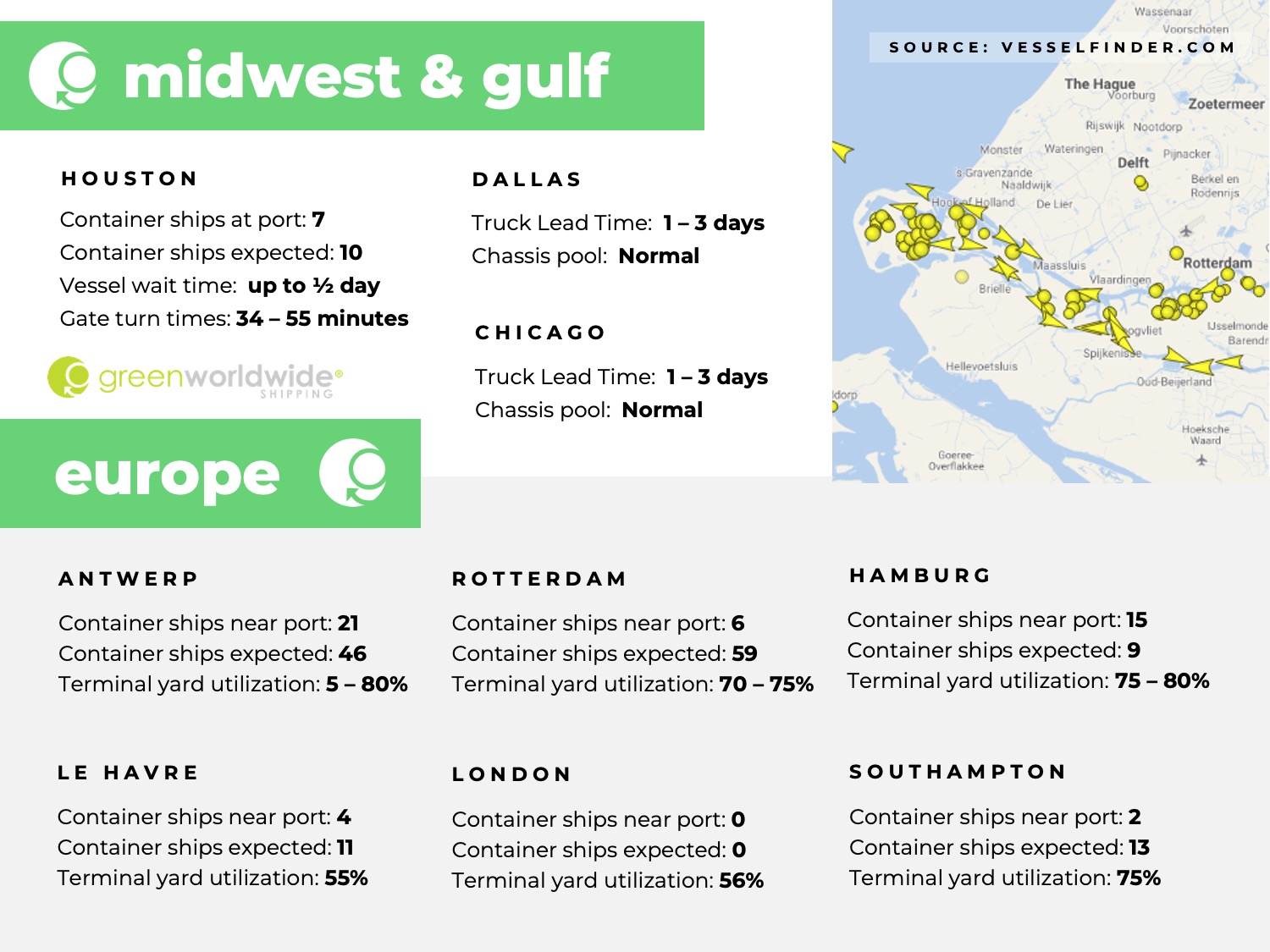

These disruptions are happening alongside other challenges, such as tariff uncertainty, the Lunar New Year surge, and potential labor negotiations on the U.S. East and Gulf coasts. Shippers should stay alert for congestion surcharges that could kick in if labor disruptions occur when the ILA-USMX agreement expires on January 15, 2025. These surcharges will only apply if there are actual disruptions and won’t affect shipments that have already been gated in before January 20, 2025.

As we move into the first quarter of 2025, the market remains strong, but it’s clear that shippers need to stay flexible and proactive. With shifting demand patterns, new alliances, and seasonal disruptions, planning ahead will be critical to avoiding bottlenecks. By diversifying supply chain networks and preparing for potential disruptions, businesses can stay ahead of the curve.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.