Although they have a lot of similarities and come from the same roots, the HTS codes and the Schedule B codes are not the same. These terms can be easily used incorrectly and it’s important to understand the difference as an importer and an exporter in the United States.

Let’s distinguish between the terminology.

GLOBAL SYSTEM

Harmonized System (HS) codes are defined and administered by the World Customs Organization (WCO) and they serve as the foundation for both import and export classification systems. These codes define the 4-digit and the 6-digit headings and subheadings for the United States HTS & Schedule B, defined below.

It’s important to note, the HS codes are uniform and recognized in most of world trade. This means if you export from the United States, the HS code in the country of destination will almost certainly be the same in that country. Of course, the suffix of the full code in that country will vary, but it’s a good place to start. It’s a common practice to have this code on export paperwork for the reference of the consignee, but it’s always best to be sure both parties agree on the determined HS code prior to shipping.

IMPORTING – UNITED STATES

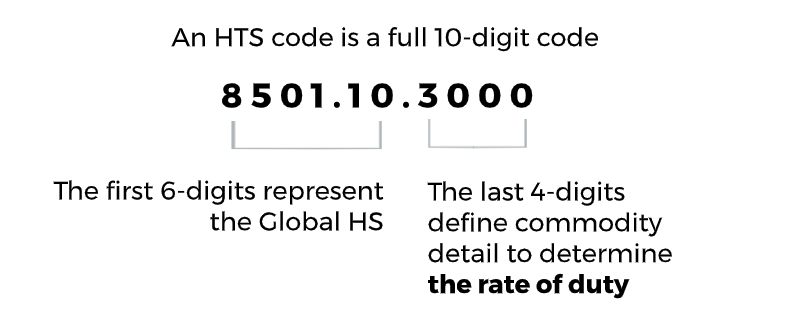

The Harmonized Tariff Schedule (HTS), also known as the Schedule A, is the United States import classification system. It is administered by the U.S. International Trade Commission. An HTS code is a full 10-digit code which utilizes the 6-digit headings and the subheadings from the WCO HS. The last four digits of the US HTS code are used to describe the product using specific commodity details (composition, material, function, etc.) which will define the rate of duty for the imported goods.

EXPORTING – UNITED STATES

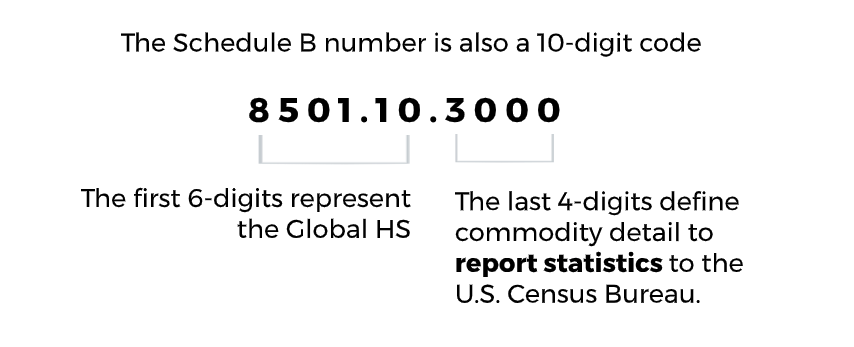

For classification of physical goods exporting out of the United States, we utilize the Schedule B designation. Schedule B is administered by the U.S. Census Bureau and just like the import HTS, the export Schedule B relies on the Global System Harmonized System issued by the WCO for its headings and subheadings. Schedule B numbers are used to report statistics to the Census Bureau, not to assign duty rates like the U.S. HTS.

Interestingly, in most cases, you can use an HTS number in place of a Schedule B for export from the United States. You cannot, however, do the reverse & use a Schedule B in place of an HTS for an import into the United States.

It’s incredibly important to determine the proper HTS or Schedule B code for your imported and exported products. There can be consequences for misclassification of your products which can include:

- Fines and Penalties

- Incorrect Paperwork, Including Certificates of Origin

- Additional Costs for the Consignee

- Delays

Beyond just determining your proper classifications, it’s critical provide them to reputable Customs Brokers for the accurate filing of your Customs declarations.

Having your HTS and Schedule B codes defined, and the processes described in your Import & Export Compliance Manuals is a great place to start on your due diligence as a company doing business internationally.

need schedule classification clarity?

Contact Green Global Trade Experts at [email protected]

IMPORTERS & EXPORTERS NEED A RELIABLE COMPLIANCE PARTNER TO GUIDE THEM THROUGH THIS REGULATORY MAZE

meet kate rayer

Global Trade Manager, LCHB

Green Worldwide Shipping, LLC