One key piece of information needed to have goods cleared by U.S Customs & Border Protection (CBP) is the HTSUS code for each of the products being imported. The HTSUS code, or classification, is based on many different factors including what the product is, what it is made of, what it is used for, etc. It is crucial for importers to understand their classifications before beginning the importing process since this will determine the amount of duty owed upon importation.

Almost all countries around the world use classification systems based on the Harmonized Schedule (HS). In the United States, we use the Harmonized Tariff Schedule of the United States (HTSUS) for statistical purposes and for classifying imported goods to determine the appropriate tariff rates.

The HTSUS was enacted in January 1989 and replaced the Tariff Schedules of the United States. A full HTSUS code consists of ten digits – the first six digits are globally harmonized with the HS, and the final four digits are assigned by the U.S. government based on product descriptions.

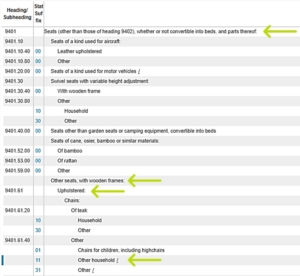

For example, wooden-framed, upholstered chairs for household use are typically classified under 9401.61.4011*, as seen here in the Harmonized Tariff Schedule.

*We recommend verifying this information with your Customs broker before use.

A licensed Customs broker can be the first stop for importers looking to determine the classifications for their products. To do this, a broker will review certain documents to verify the product description & details. These documents may include:

- Technical data sheets

- Websites

- Photos

- Commercial documents

It is important to remember that CBP places responsibility for proper classification on importers.

Even with a broker’s classification advice, it is always recommended that importers secure a binding ruling from CBP to confirm that the HTSUS codes used on their Customs entries are correct. An importer or their broker – working on behalf of the importer – can request a ruling from CBP. Ruling response times from CBP are usually around 30 days, although it may take longer if CBP requests additional information or samples in order to make their determination.

Green Worldwide’s licensed Customs brokers are here to help with your classification needs, whether you are just looking for some advice or wanting to request a ruling from CBP. Reach out to us today to see how we can help you determine your classifications.

Stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn, and make sure to check out our website at greenworldwide.com.

you ask, green answers

Don’t see the answer you’re looking for? Submit any supply chain question and one of our Green Freight Experts will answer it for you.