In 2023, Mexico emerged as the United States’ largest trading partner, surpassing China for the first time. Trade between the two nations surged to nearly $800 billion, signaling a dramatic shift in global supply chain dynamics. This realignment is largely attributed to several recent disruptors, including U.S.-China trade tensions, drought-induced restrictions on Panama Canal traffic, and the lingering effects of COVID-19 on logistics. As a result, the U.S. is increasingly turning to Mexico for essential imports such as energy products and semiconductors to diversify its supply base and reduce reliance on China.

Nearshoring involves relocating business operations or sourcing products from distant countries to nearby ones, typically within the same region. This strategy helps companies reduce operational costs, shorten supply chains, and improve efficiency by cutting down on transportation times. It also facilitates better communication and faster delivery, making it a popular choice for businesses seeking to streamline operations while remaining competitive in a global market.

This trend aligns with a growing nearshoring movement, where U.S. companies look to Mexico as a manufacturing hub due to its cost-effective labor, geographic proximity, and shared time zones, which help to reduce shipping times and costs from Asia. Enhanced U.S.-Mexico diplomatic ties have further cemented this economic partnership, bolstered by trade-facilitating agreements like the United States-Mexico-Canada Agreement (USMCA).

DEMAND FOR EFFICIENT CROSS-BORDER SUPPLY CHAINS

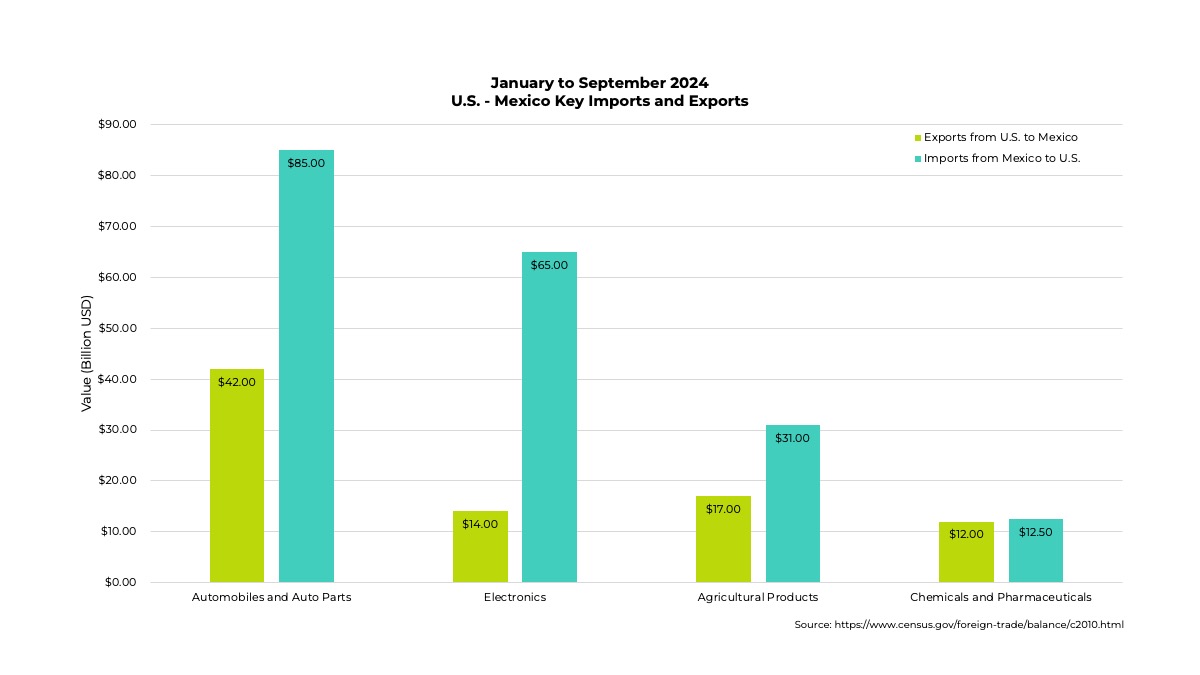

Trade between the U.S. and Mexico saw a sharp increase, reaching $632.3 billion from January through September 2024—marking a 36.5% rise over the same period in 2019. This sustained growth places enormous pressure on logistics networks, which must evolve to meet demand by establishing efficient, interconnected cross-border supply chains. The logistics sector is focusing heavily on this development, with particular emphasis on reliable and transparent systems to support the rising freight volumes.

An important aspect of this strategy is the expansion of logistics networks, particularly along major U.S.-Mexico crossings such as Laredo, Texas. New warehouses and distribution centers are opening frequently; however, long-term success hinges on the maturation of the underlying transportation and communication networks. Stakeholders in the logistics industry emphasize the need for interconnected, adaptive systems to accommodate the increasing complexities of cross-border trade. Partnering with an experienced U.S.-Mexico cross-border logistics team is essential for successful customs clearance and speed through ports of entry.

“As U.S.-Mexico trade continues to grow, it’s clear that maintaining the efficiency of cross-border logistics requires more than just expanded infrastructure. The focus must be on creating flexible, interconnected systems that can handle increasing volumes without compromising speed. In my experience, the key to success is not only having the right facilities in place, but also ensuring that the teams on both sides of the border are well-coordinated and ready to adapt as the landscape evolves.”

Andy Bollefer | Branch Manager, Laredo and Dallas | Green Worldwide Shipping

INFRASTRUCTURE AND LOGISTICS CAPACITY

New logistics hubs at border crossings have facilitated goods movement, yet physical expansion alone cannot address the evolving challenges of cross-border logistics. Border crossing lanes, processing capacity, and modernized customs procedures are equally crucial. For example, the number of northbound trucks entering the U.S. from Mexico has increased by 18.1% in the first nine months of 2024 compared to 2019, highlighting the need for expanded infrastructure to accommodate this demand.

To address capacity constraints and improve efficiency, the logistics industry is increasingly integrating advanced technology. For example, the Automated Commercial Environment (ACE) and Multi-Energy Portal (MEP) systems have improved customs processing times by 30-40%, reducing bottlenecks at high-traffic crossings. Digital innovations help to streamline data management, optimize shipment routing, and improve visibility across the supply chain.

FUTURE OUTLOOK: A SUSTAINABLE, COLLABORATIVE PATH FORWARD

With demand for U.S.-Mexico trade projected to increase, a focus on infrastructure modernization, and technological advancement is necessary. By prioritizing transparent, efficient logistics networks, stakeholders can create a resilient cross-border trade environment. Close cooperation between the U.S. and Mexico will be essential in shaping a mutually beneficial trade landscape, one that underscores adaptability and continuous improvement in the face of global challenges.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.