The freight market has experienced significant shifts over recent weeks, with a noticeable improvement in space availability across major trade lanes heading into Week 3. As we approach Chinese New Year (CNY), carriers are actively seeking to secure additional volume to strengthen their rolling pools ahead of anticipated factory closures. However, weather disruptions within the U.S. have created delays for freight throughout the U.S.

CAPACITY PRESSURES AND ALLIANCE REALIGNMENTS

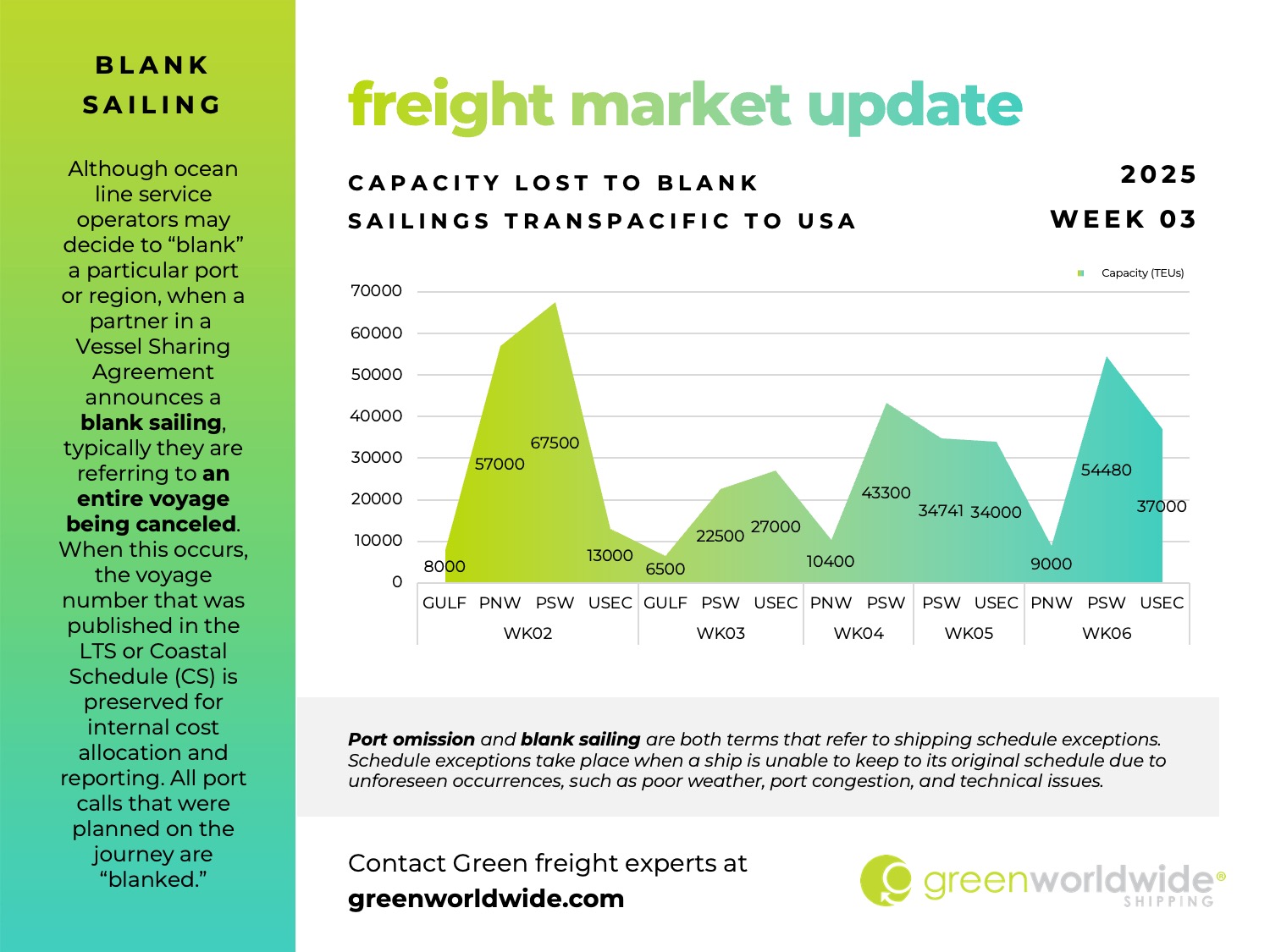

Despite the current easing in space constraints, the market is bracing for capacity pressures as new alliance structures take effect in February. Two key alliances—GEMINI and PREMIER—are set to commence operations from February 1, resulting in service changes and vessel transitions that will temporarily disrupt capacity.

- GEMINI Alliance (Hapag-Lloyd, Maersk): This new partnership aims to streamline capacity management across core trade lanes but will require an adjustment period as vessels are reassigned.

- PREMIER Alliance (ONE, Yang Ming, HMM): The formation of the PREMIER alliance comes with notable capacity challenges. Following Hapag-Lloyd’s departure from THE Alliance (THEA), carriers within PREMIER are grappling with immediate capacity shortages. This shortage is expected to impact allocation levels, particularly in February.

The adjustment period could disrupt shipment planning, particularly for businesses that depend on flexible capacity in February. Additionally, capacity cuts could lead to temporary disruptions in service schedules.

WILDFIRES AND WINTER STORMS DISRUPT FREIGHT ACROSS THE U.S.

The U.S. freight market has been significantly impacted by environmental disruptions in early 2025, including ongoing wildfires in California and recent winter storms across the central, eastern, and southern states. These events continue to pose challenges for supply networks, affecting trucking, rail, air cargo, warehousing, and port operations.

California Wildfires

California is once again battling devastating wildfires that have claimed lives, displaced thousands, and destroyed entire communities. The Palisades and Eaton Fires, among others, have scorched large areas of Southern California, leaving many residents without homes or basic resources – our thoughts are with those impacted by these fires.

From a freight perspective, the fires have disrupted key transportation routes and operations, particularly in Los Angeles and surrounding areas:

-

- Pacific Coast Highway (State Route 1) remains intermittently closed due to fire activity and safety concerns.

- Interstate 5, a vital north-south freight corridor, has experienced periodic closures and delays near fire-affected areas.

- Los Angeles International Airport (LAX) and Hollywood Burbank Airport (BUR) have both seen temporary disruptions in cargo operations due to poor visibility and air quality concerns.

- Rail services through Ventura and Los Angeles counties have experienced delays as Union Pacific and BNSF navigate fire-damaged tracks.

- Ports of Los Angeles and Long Beach continue to operate but face sporadic delays due to impacted trucking routes and workforce availability.

The wildfires are ongoing, and conditions remain unpredictable. Logistics providers are working to adapt, prioritizing safety while addressing delays and rerouting shipments where possible.

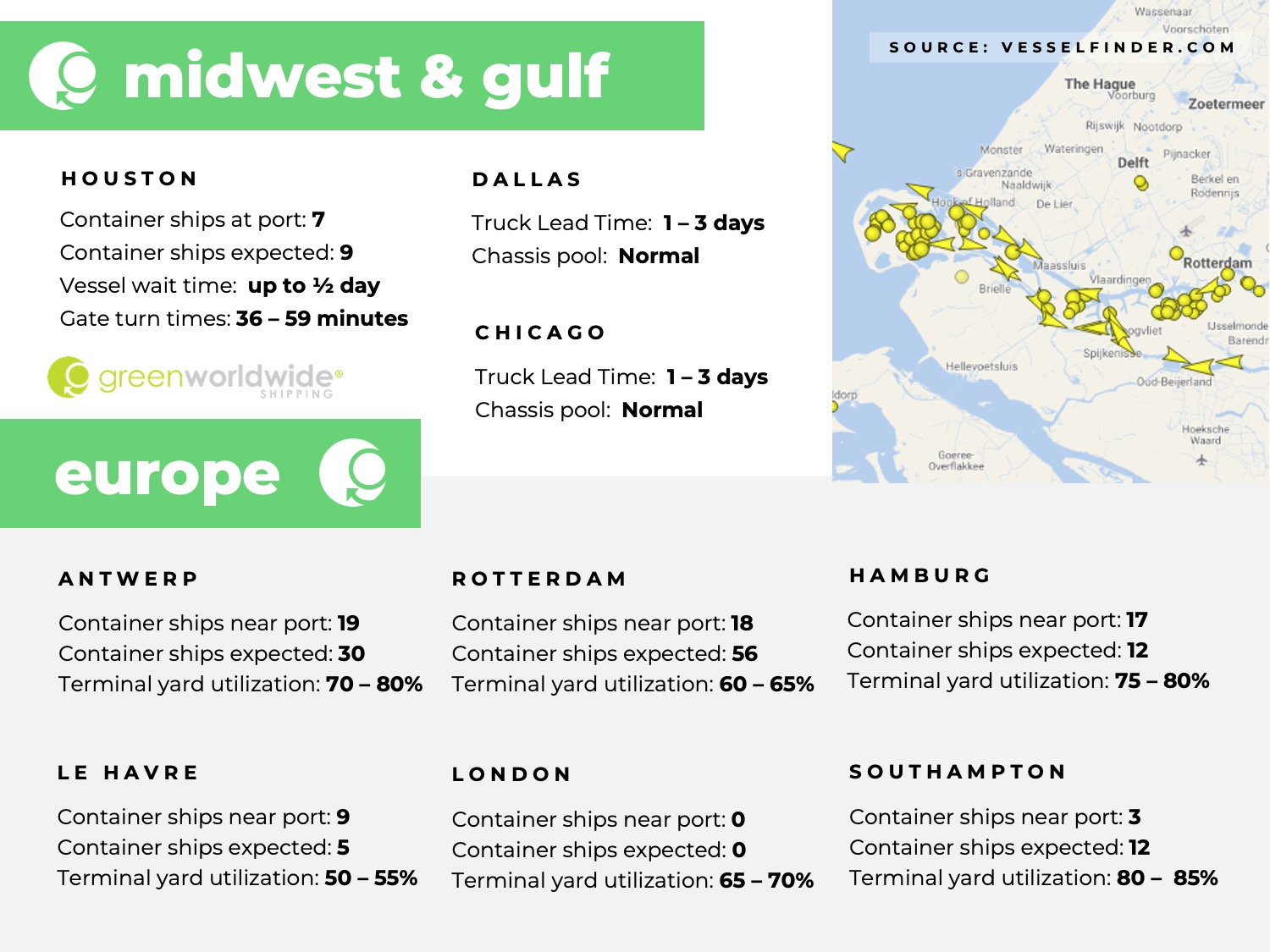

Winter Weather Impact on U.S. Freight Operations

Late last week, a polar vortex and accompanying winter storms brought extreme cold, snow, and ice to large parts of the U.S., impacting freight operations across Kansas, Missouri, Indiana, Kentucky, Texas, and Oklahoma. While most affected highways, rail networks, airports, and ports have returned to normal operations, some minor delays persist in localized areas. The Port of Houston and Dallas/Fort Worth International Airport (DFW) experienced temporary slowdowns but are now fully operational. Meanwhile, warehousing and distribution centers in Texas and Oklahoma have resumed regular activities after temporary closures due to power outages and icy conditions.

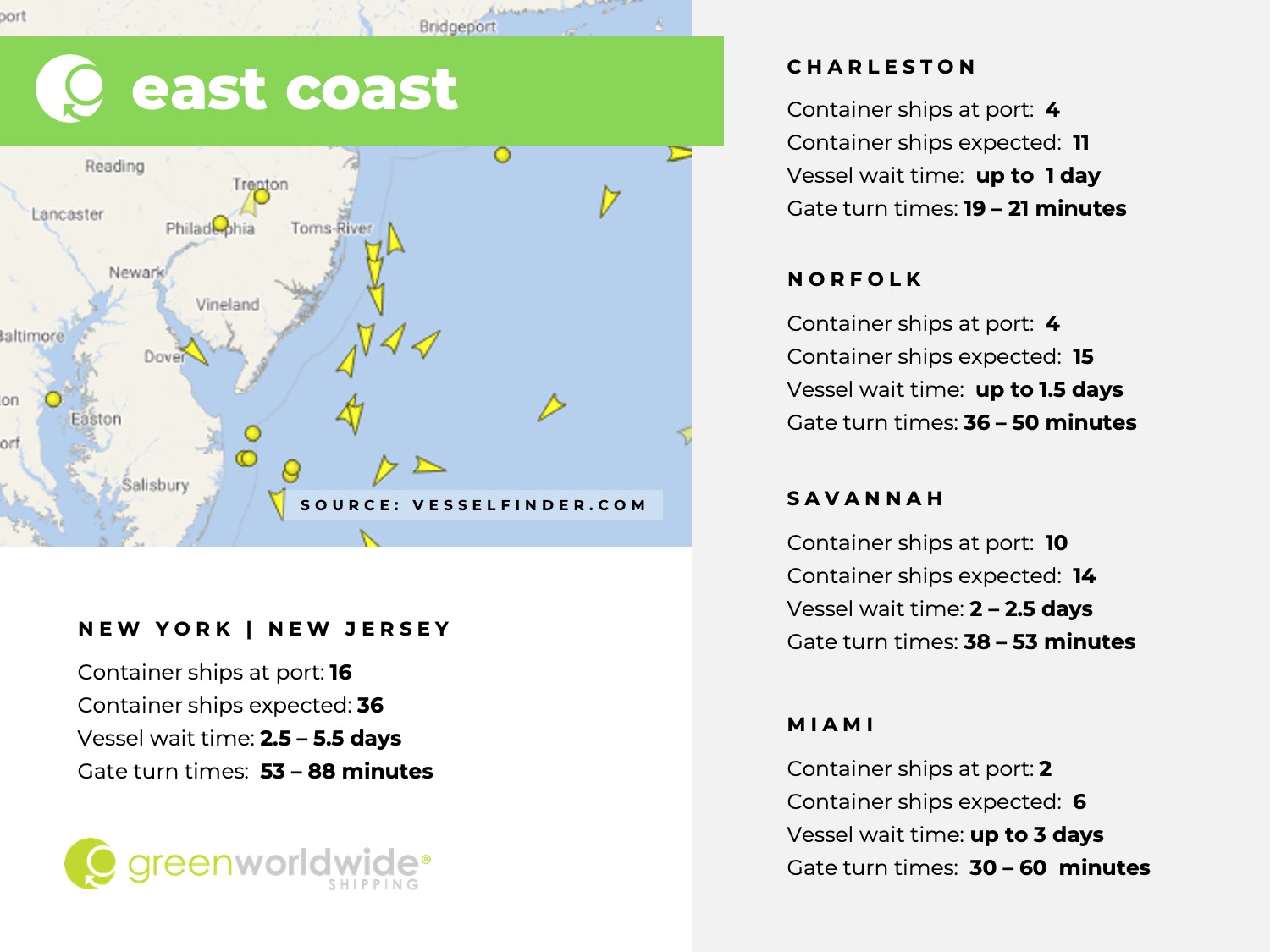

ILA-USMX AGREEMENT BRINGS STABILITY TO EAST AND GULF COAST PORTS

In a positive development for the U.S. freight market, the International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX) recently reached a tentative agreement, ensuring labor peace at East and Gulf Coast ports. This agreement is expected to bring much-needed stability to key ports, including the Ports of New York/New Jersey, Charleston, Savannah, Houston, and Mobile, which handle a significant portion of U.S. container traffic.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.