WEEK 2 FREIGHT MARKET UPDATE: TENTATIVE LABOR AGREEMENT, SLOWDOWN, TARIFF RISKS, AND LUNAR NEW YEAR IMPACT U.S. PORTS

As we enter the second week of 2025, the freight market is navigating a blend of factors—seasonal slowdowns, political uncertainty, and the typical start-of-year adjustments. While demand remains resilient, certain key events are expected to bring challenges. Labor updates, potential tariffs, and the approaching Lunar New Year are all factors that will influence market dynamics in the coming weeks.

LABOR AGREEMENT PROVIDES RELIEF FOR EAST COAST OPERATIONS

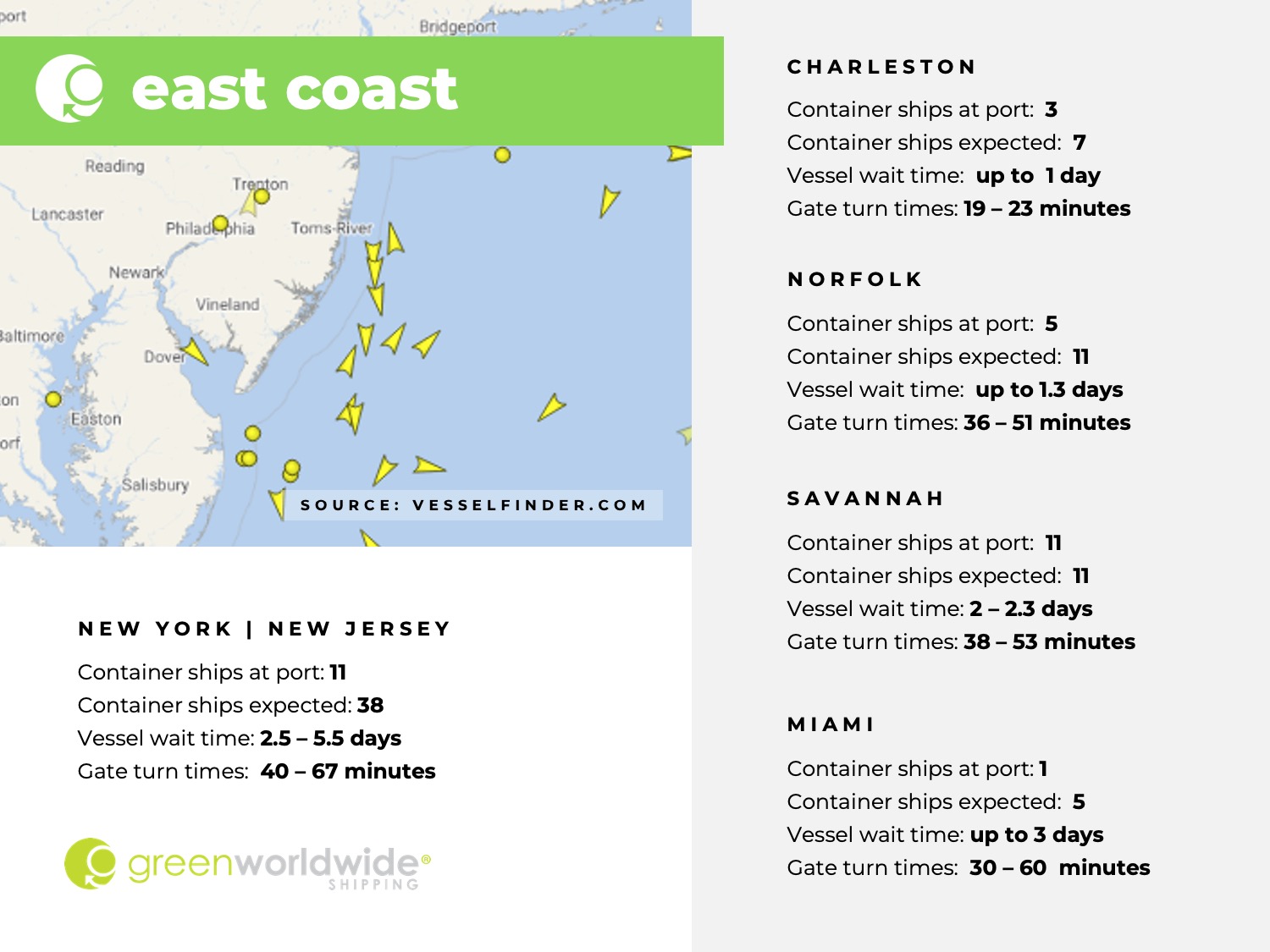

The International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX) have reached a tentative agreement on a new six-year Master Contract, averting the risk of labor disruptions or strikes that were looming as the January 15 expiration date approached. This agreement provides much-needed stability for operations at East and Gulf Coast ports, ensuring the continuation of cargo flow while mitigating immediate concerns over labor-related disruptions. Businesses can now focus on other market conditions without the threat of work stoppages on the horizon.

THE IMPACT OF FRONT-LOADING AND POTENTIAL CROSS-BORDER TARIFFS

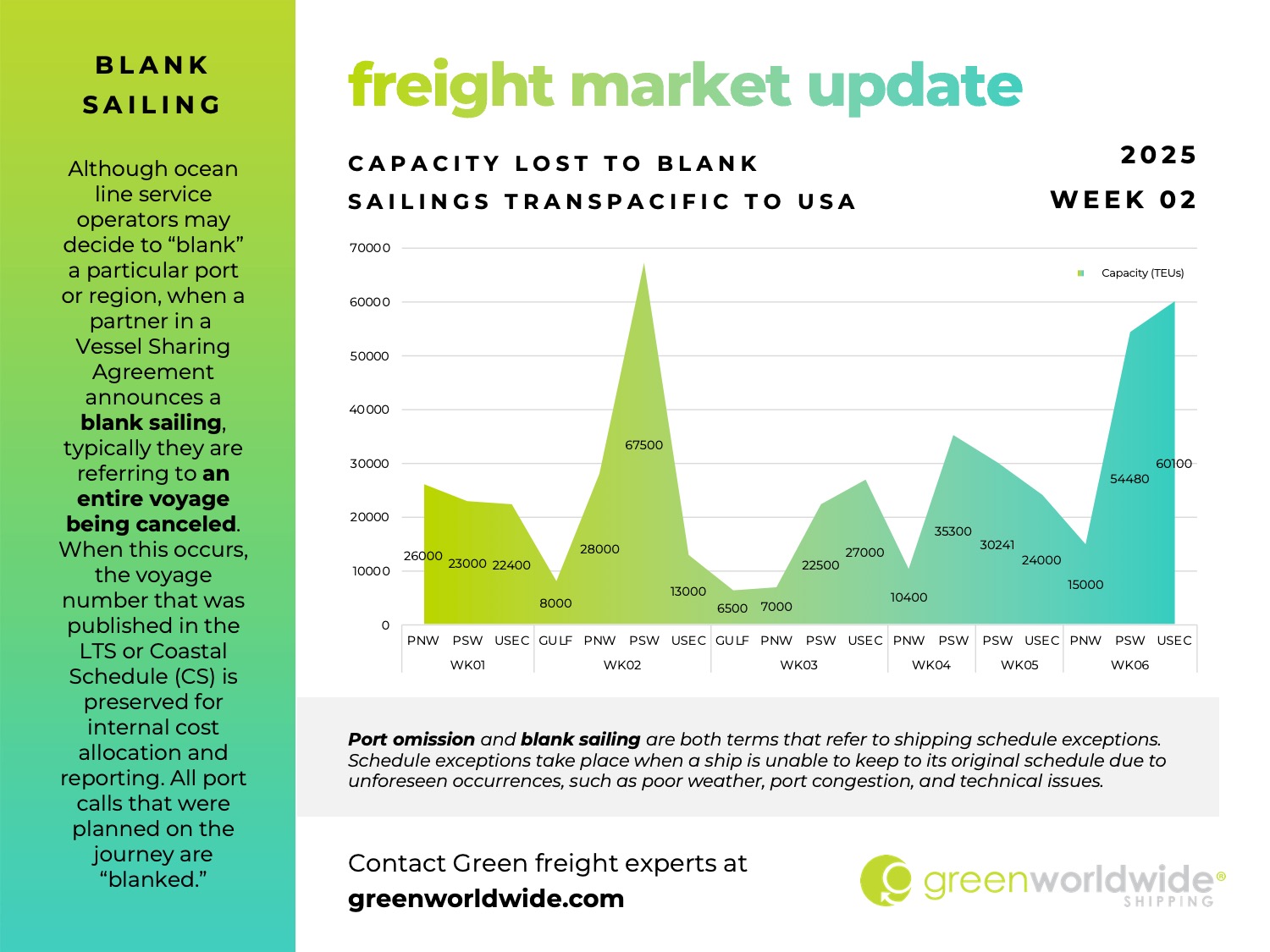

Since late December, front-loading on Transpacific routes has surged, as shippers look to avoid potential disruptions from new tariffs and labor concerns. With the resolution of the East Coast labor issue, the focus now shifts to ongoing political risks, particularly regarding trade policies. Businesses must remain flexible, as trade policy shifts can significantly alter cost structures and timelines with little notice.

The possibility of 25% tariffs on imports from Mexico and Canada continues to loom, threatening to disrupt trade flows. If these tariffs are enacted, some volumes may shift back to Transpacific routes, especially in the e-commerce sector. While the full impact of these tariffs remains uncertain, businesses involved in North American cross-border trade should stay alert for potential fluctuations in demand and routing decisions.

LUNAR NEW YEAR: EARLIER SLOWDOWN AND SLOWER BOOKING TRENDS

This year’s Lunar New Year will see an earlier-than-usual slowdown, with many Chinese factories shutting down 3 to 5 days ahead of the traditional break. This change is expected to disrupt production schedules and reduce outbound shipment capacity, leading to lower shipping volumes by late January. This early slowdown may extend into February, further affecting shipping schedules. Businesses should be prepared for slower bookings and possible delays, as carriers adjust to these changes.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.