This Week 42 Freight Market Update finds the U.S. East Coast recovering from the ILA strike and recent Hurricanes Helene and Milton. Elsewhere, capacity dips as demand wanes due to strategic adjustments made by importers ahead of the ILA strike and China’s Golden Week Holiday.

HURRICANE MILTON: U.S. EAST COAST PORT IMPACT

Hurricane Milton, one of the most powerful storms in decades, swept through the Atlantic and left a trail of destruction along the U.S. East Coast. Ten major ports, including Tampa and Jacksonville, were temporarily shut down. Although both reopened on October 12, vessel movements remain restricted at Port Tampa, with limited operations confined to daylight hours under one-way traffic control.

On Florida’s west coast, severe flooding has caused widespread road closures, significantly hindering surface transportation. This situation has exacerbated the regional trucking capacity shortage, leading to operational delays that are likely to affect shipper services for the foreseeable future. The recovery process in the region continues, with logistical challenges expected to persist in the short term.

EARLY IMPORT SURGE CAUSES REDUCED OCTOBER DEMAND

A strategic surge in early imports has resulted in reduced demand for shipping services this October. U.S. importers, anticipating potential strikes at East and Gulf Coast ports, front-loaded holiday merchandise shipments earlier in the year. This preemptive measure was aimed at avoiding disruptions during the critical holiday season.

The accelerated flow of goods has intensified the usual post-Golden Week slowdown, creating a significant dip in logistics activity. Ports, shipping lanes, and freight services are now seeing a noticeable drop in volume, contributing to a quieter-than-expected period for U.S. logistics operations. The decline is expected to continue through the remainder of October as earlier shipments meet current inventory needs.

ILA STRIKE FALLOUT

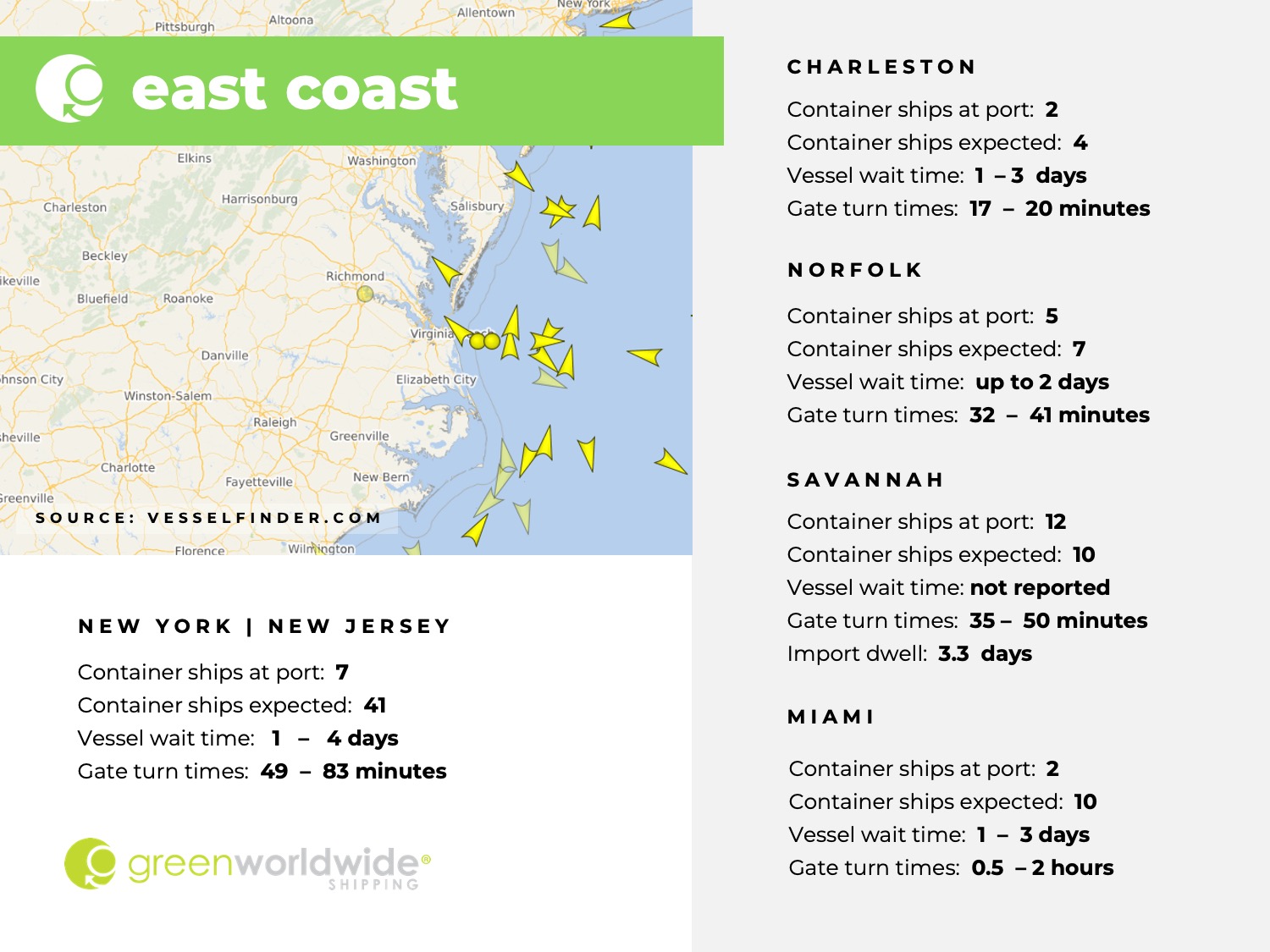

While the ILA strike has officially ended, its impact on the U.S. East Coast and Gulf Coast ports is still being felt. Ports have resumed operations, and the backlog is anticipated to clear in the coming weeks. However, the strike’s disruption has caused vessels scheduled for return to Asia to fall behind, leading to an increase in blank sailings along the Asia-U.S. East Coast route.

Carriers are in no rush to restore capacity due to the weakened demand, further extending the effects of the strike on global trade flows. Blank sailings are expected to continue through October and possibly into November, keeping shipping capacity tight for U.S. imports from Asia.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.