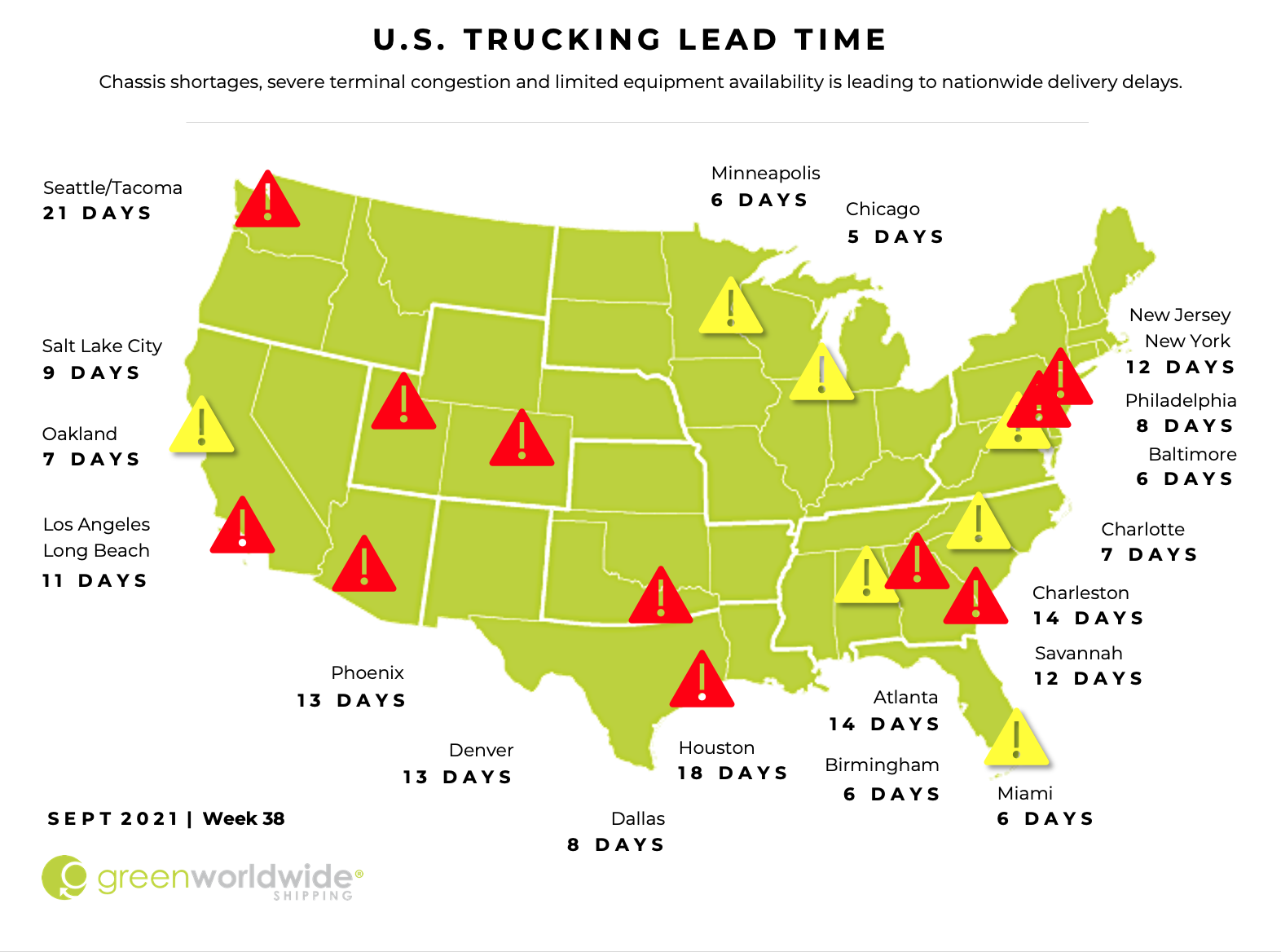

I. TERMINAL CONGESTION

Ports across the United States are dealing with severe terminal congestion issues, maxed out rail yards, limited warehousing, and chassis shortages caused by a never-ending consumer demand for import goods.

As vessels stack the horizon waiting to berth at marine terminals in Los Angeles and Long Beach, and shippers turn to East Coast ports like New York to feed West Coast inventories, trucking rates and delivery delays are increasing nationwide.

Record breaking import volumes have strained U.S. transportation infrastructure as rail, terminal and dray yards burst at the seams to catch up from a year of constant bottlenecks and delays at both origins and destinations. COVID-related lockdowns, severe weather, and chassis shortages have all contributed to backlogs of containers urgently waiting to be picked up in the United States.

II. CHASSIS SHORTAGE

The shortage in chassis equipment is specifically contributing to delivery issues at terminals and yards on both coasts, as well as inland rail hubs, like Chicago. Trucking lead time across the country is increasing, while street dwell of containers with chassis is also on the rise.

Meanwhile, chassis equipment production has officially reached maximum capacity with no ability to add more chassis supply into the market.

In March, the U.S. International Trade Commission imposed 200 percent antidumping and countervailing duties on the world’s largest producer of chassis, China Intermodal Marine Containers (CIMC).

While a temporary win for American chassis manufacturers, the lack of immediate investment in building additional capacity to meet urgent demand has backlogged order of new chassis equipment through 2022.

III. DRIVERS NEEDED

Over the last decade, the trucking industry has struggled to recruit and retain enough drivers to fill the increasing demand for trucking transport. Trucking companies often compete for the same pool of employees as construction, which is growing and offers local, consistent work and good benefits.

Some domestic carrier groups have petitioned Congress to help in finding a solution. In the meantime, the driver shortage continues to add to transportation costs as demand for deliveries nationwide increases.

IV. LIMITED SEMICONDUCTOR COMPONENTS

Finally, heavy-duty truck prices are increasing as an international shortage of semiconductor components used in the manufacturing of heavy-duty trucks caused forced production downtime over the summer at major U.S. truck manufacturers.

A variety of industries, from automotive to computer and aerospace, compete for the same semiconductor chip parts. As a result of the limited supply of semiconductor components, increasing demand is significantly driving up the price and bottlenecking new heavy-duty truck manufacturing needed for domestic deliveries.

As Green continues to monitor the situation, stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.